London Fork: The New Ethereum Monetary System

On August 5th, 2021 the London Hard Fork was implemented in Ethereum to make transaction fees more predictable for users and as a solution to challenges in price volatility and scalability issues. To illustrate, the DeFi market makes an exceptional example.

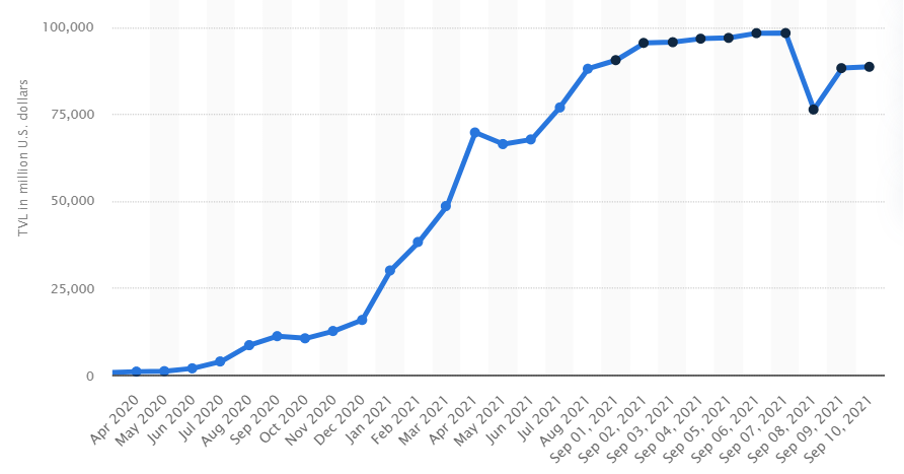

The decentralized finance (DeFi) market size according to Statista (2021) is about $88 billion dollars, as measured by the amount of cryptocurrency locked which has increased exponentially since June 2020. The increase has to do with new appliances in the DeFi market and their popularity that has increased the congestion and pushed transaction fees to new highs. DeFi appliances give users more control over the data the apps manage and expand the utility of cryptocurrencies to more complex financial use cases such as security tokens, secondary market places, digital loans, shares, bonds, derivatives, tokenized fund shares, among others (Hertig, 2021). In response to these challenges, Vitalik Buterin proposed EIP 1559 which outlines a major change to Ethereum’s transaction fee mechanism.

Figure 1. Total Value locked (TVL) of cryptocurrency in DeFi from 2017 to September 10, 2021. Source: Statista 2021

Ethereum changed from a first-price auction to a base fee + tip scheme, setting a minimum amount per transaction plus a tip. The base fee is burned and the tip is directed to the miner. In addition, the current base fee would be in function of the prior base fee, the prior block size, and the average block size. The preceding implies an inflation and volatility strategy that substantially improves the Ethereum ecosystem. This is part of a set of changes in Ethereum to improve scalability and sustainability. We hope to see Phase 1.5 at the end of the year: the merge between the mainnet chain and the beacon chain signaling the end of energy-intensive mining.

This article addresses the changes and the impact of the London Hardfork on investors and issuers using Ethereum to settle transactions.

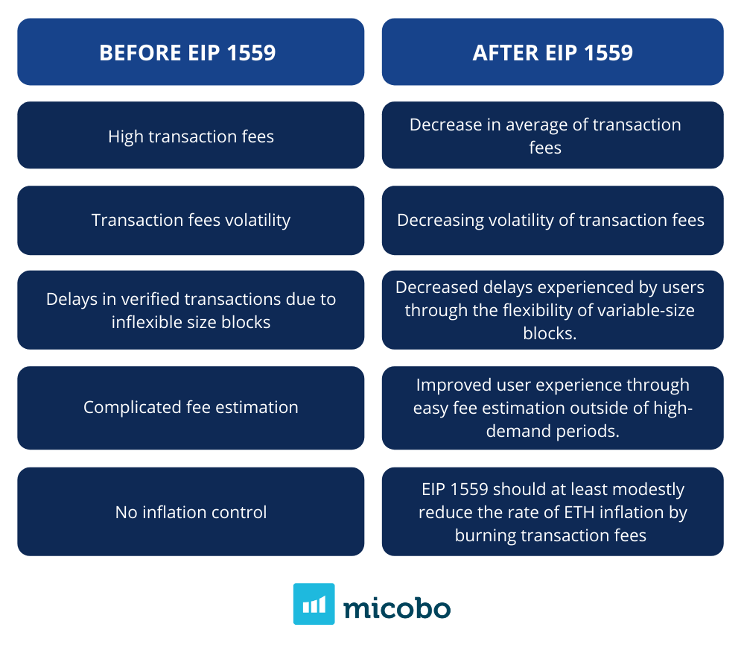

Table 1. Before and After EIP-1559. Source: Roughgarden (2020)

Does the EIP 1559 reduce transaction fees?

An investor/issuer executing a transaction pays the base fee, a minimum value in order to be included in a block plus a tip set by the investor/issuer (expected to be proposed by wallets). This would cover the computational power and would work as an incentive for miners to pick up the transaction faster (See Eq. 1). On the other side, miners decide which transactions to include in their block and its order (Ethereum, 2021a).

The current total fee per transaction in Ethereum is:

Gas Units (Gas Limit)*(Base fee + Tip) (Eq. 1)

Where the base fee is the minimum price per unit of gas for inclusion in a block, calculated by the network based on demand for block space. The tip compensates miners for executing and propagating user transactions in blocks and is expected to be set automatically by most wallets.

The preceding represents a substantial change in the estimation of prices for users. It allows them to define prices easily without the struggle of figuring out the best gas price in order to be elected by the miner. And not only this, with a changing base fee that depends on the prior block size, the fee volatility is decreased.

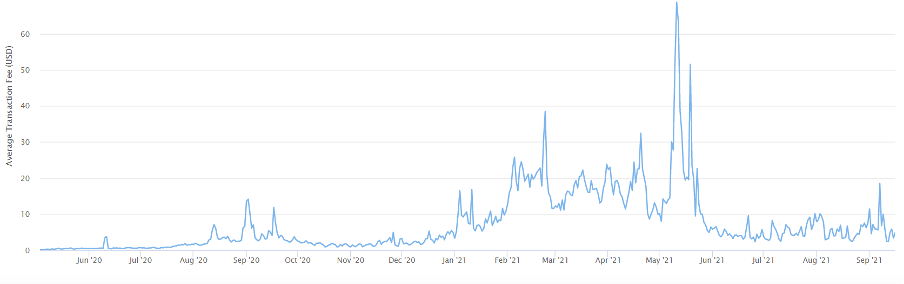

In Figure 2, the average transaction fee (USD) in May 2021 was above 60 dollars (showing how volatile the first-price auction can be), however, after August 5th the average transaction fee ranged between 2.5 USD and 18.5 USD, an average of 5.5 USD transaction fee since August 5th. With a base fee users avoid overpaying and fees tend to be around the base fee. Hence, there is a reduction in transaction fees.

Figure 2. Average transaction fee in USD. Source: Etherscan.io (2021)

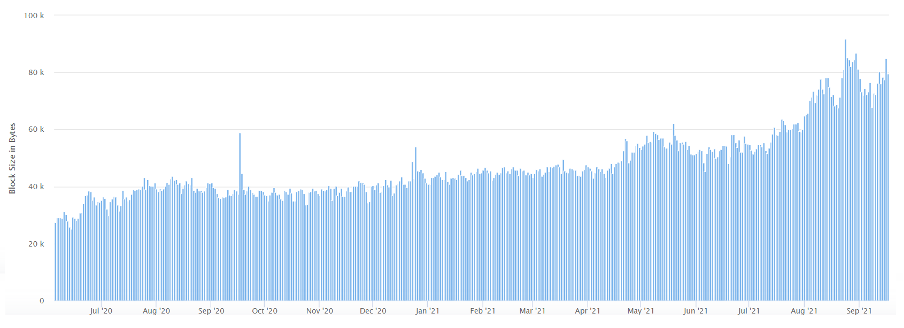

It has been a month since the EIP-1559 implementation and block sizes have expanded which signals high demand. And instead of extremely volatile fees, the average transaction fee has maintained a value of around 5.5 USD.

Figure 3. Block size in bytes. Source: Etherscan.io (2021)

EIP 1559 reduces volatility in transaction fees and improves investors & issuers experience

The next key change was the relaxation of the constraint of blocks having a maximum size of 12.5 million gas. EIP-1559 uses past block sizes as an on-chain measure of demand. It defines an average block size of 12.5M gas. When blocks are greater than 12.5M it signals a high demand and when blocks are less than 12.5M it signals a low demand. The maximum block size is 2 times the average block size, 25M gas, which in turn is used for controlling the network congestion (Roughgarden, 2020).

Roughgarden (2020) defines the base fee as:

base feecurrent block=base feeprior block1+18sizeprior block-sizeaverage blocksizeaverage block (Eq. 2)

This rule sets a maximum price increase/decrease of 12.5% per block (Jakub, 2020), limiting the prices’ volatility.

This provides an opportunity for the Ethereum network which is growing due to Decentralized finance (DeFi). Stable prices increase economic agents’ participation and with it the increase of Ether price. As stated by Sabalionis et al. (2020), the Ether price is significantly affected by the amount of active addresses in the Ethereum network. And if we add this to the expected Ethereum scalability, there is a promising sustainable framework for business.

As stated before, EIP 1559 would improve investors’ and issuers’ experience by facilitating the fee estimation and making it practically automatic (with a wallet’s automatic estimation). In addition, decreasing fee volatility is the first step towards a stable market. A necessary condition for any issuer.

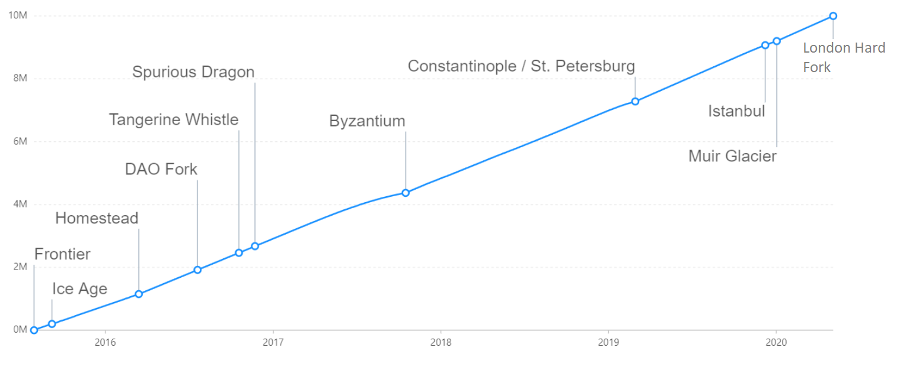

Constant improvements in Ethereum Network

The London Hard fork is one of many changes in constantly being implemented in Ethereum. Ethereum 2.0 aims to improve three main aspects of the Ethereum network; security, decentralization, and scalability. They have proposed two main changes, implementing “Proof of Stake” instead of “Proof of work” and applying “sharding” as a scaling solution.

With the release of Ethereum 2.0 we’re going to see ETH drastically increase its tx/s and therefore its commercial and consumer viability. Gas clogs, high transaction costs, long wait times in dApps and excessive energy consumption will vanish, even in a busy market. Certainly, a great advancement that will improve many of the business cases powered by Distributed Ledger Technologies.

In addition, Ethereum has many potential changes that can be seen in Ethereum Improvement Proposals. EIPs play a central role in how changes happen and are documented on Ethereum. They are the way for people to propose, debate, and adopt changes. This includes core EIPs (for low-level protocol changes that affect consensus and require a network upgrade) as well as ERCs (for application standards). For instance, EIPs have shaped the way Ethereum currently operates and adds flexibility to it. An example of this is changing the consensus protocol from “Proof of Work” to “Proof of Stake” adapting to the current world conditions.

Figure 4. History of Ethereum Hard Forks measured by block number and time. Source: Hollander (2020)

micobo’s clients (security token issuers) will benefit from Ethereum network developments thanks to the reduced costs per transaction, the scalability of the Ethereum network, security, and its stability.

With EIP 1559 integration, wallets do not have to estimate gas fees anymore. Instead, wallets can set the gas fee automatically and changes in gas fees can be predictable, improving the investors’ experience in micobo’s platform.

Gas fees will be fair depending on market conditions so that investors and issuers will save costs when there is low activity in the Ethereum network. Additionally, for ETH holders, the expectation is to increase in the short and long term.

About micobo

micobo GmbH is a leading European software company for Security Token Offerings and Blockchain Software Development (DLT). It provides fully compliant software solutions for Security Token Offerings and advises on structuring DLT- and Blockchain-based Securities. micobo empowers financial institutions with state-of-the-art technology focusing on providing a better customer experience and achieving measurable results.

Author

Laura Andrade (la@micobo.com)

References

- Ethereum. Gas and Fees. 2021. Retrieved from https://ethereum.org/en/developers/docs/gas/. Last Accessed: 25.03.2021.

- Ethereum. Ethereum Improvement Proposals 1559. 2021a. Retrieved from

- https://eips.ethereum.org/EIPS/eip-1559#gasprice. Last Accessed: 25.03.2021.

- Etherscan. Average Transaction fee in USD. 2021. Retrieved from https://etherscan.io/chart/avg-txfee-usd. Last Accessed 17.09.2021.

- Hertig, Alyssa. Which Crypto Projects Are Based on Ethereum?. 2021. Retrieved from https://www.coindesk.com/tech/2021/02/08/which-crypto-projects-are-based-on-ethereum/. Last Accessed 17.09.2021.

- Hollander, Luit. History of Ethereum Hard Forks. 2020. Retrieved from https://medium.com/mycrypto/the-history-of-ethereum-hard-forks-6a6dae76d56f. Last Accessed 17.09.2021.

- Roughgarden, Tim. Transaction Fee Mechanism Design for the Ethereum Blockchain:

- An Economic Analysis of EIP-1559 .2020. Retrieved from https://timroughgarden.org/papers/eip1559.pdf. Last Accessed 17.09.2021.

- Statista. Amount of cryptocurrency held in decentralized finance, or DeFi, worldwide from August 2017 to September 10, 2021(in million U.S. dollars). 2021. Retrieved from https://www.statista.com/statistics/1237821/defi-market-size-value-crypto-locked-usd/. Last Accessed 17.09.2021.