Enterprise Tokenization Platform & API Integration

Open the gate to digital assets & investment with us: Securely, transparent, and efficiently.

Open the gate to digital assets & investment with us: Securely, transparent, and efficiently.

micobo Digital Assets Platform: Whitle-label SaaS & API

DLT enables secure tokenization of financial assets. Thanks to this ground-breaking technology, we can significantly lower costs for issuing and transferring securities, offer higher security, more efficient fungibility, and access to new asset classes and a global pool of investors.

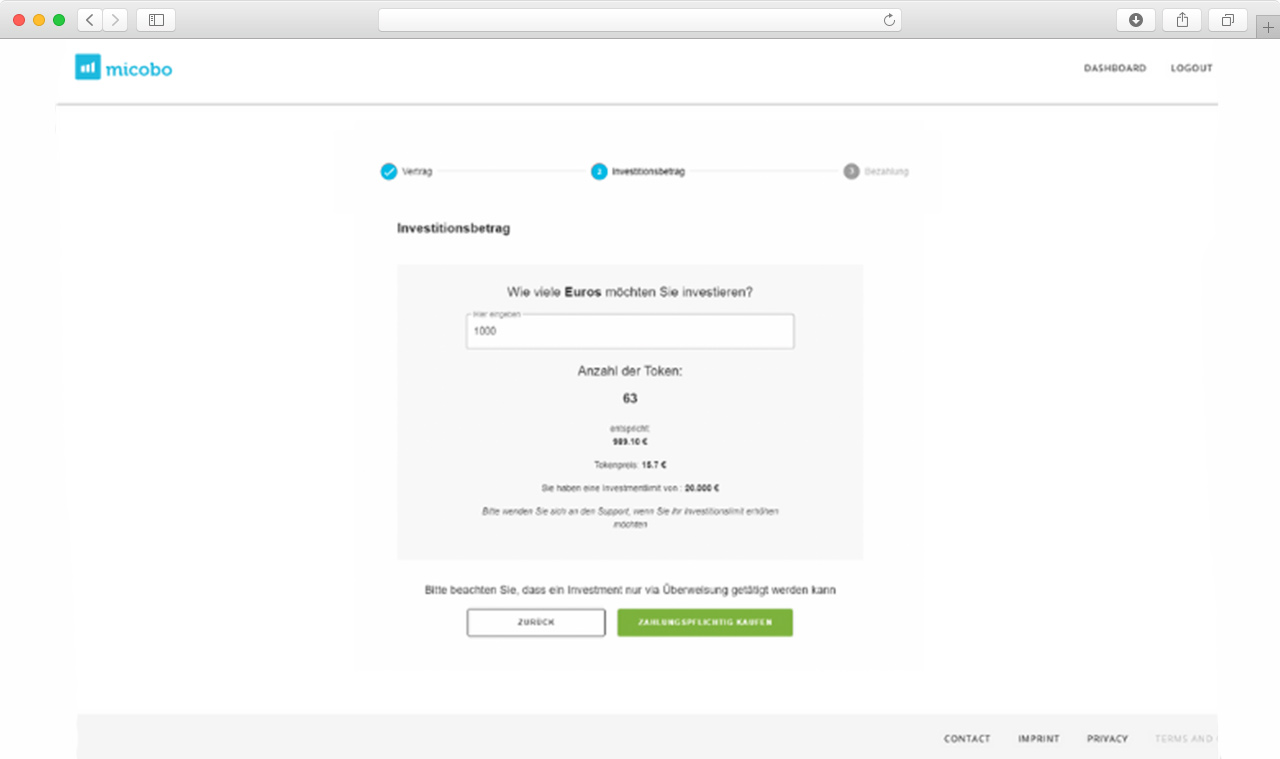

micobo's enterprise tokenization platform provides an entire software toolkit -suite- as a fully customizable white-label solution that allows you to issue tokenized securities efficiently. With our suite, you can safely and fully compliantly manage the digital investment process and engage with your investors to unlock more liquidity.

Fully compliant investor onboarding & AML screening: Investor profiling following regulatory requirements (e.g., MiFID II) with complete digital investment and payment processes for an unparalleled user experience.

Comprehensive user rights management (e.g., admin, paying agent, regulator) and CRM functionalities to monitor processes and transactions in real-time. Engage with your white-listed investors to learn more about their investment interests and appetite.

Efficiently manage all events in the issued digital assets’ lifecycle: With our all-in-one solution, administrators can whitelist investors, perform dividend and coupon payments, pause and manage trading, as well as mint, distribute and burn digital assets.

Compliantly issue and manage digital assets with fully integrated multi-sig workflows and safe key storage for maximum security. Get real-time reporting and a built-in registry for your issued digital assets.

Directly engage investors and keep them up to date with your latest developments. Easily communicate and message your users. Find all information in a detailed user dashboard.

Allow white-listed investors to trade digital assets peer-to-peer on our compliant OTC Trading Board or use our Uniswap integration for trading through an automated market maker protocol.

We unlock assets and create new capital markets with more liquidity and efficient governance

Using blockchain and other distributed ledgers allows for intertwined communication of participants, making redundant record keeping obsolete. This lowers costs in all "back-office" transactions, making emission and management of digital securities cheaper than traditional ones.

The blockchain technology digitizes existing, often still paper-bases processes. The speed of transactions increases considerably though the use of distributed ledgers, benefiting from the efficiency gains of decentralized and digital transactions.

The digitization of securities drastically simplifies the transfer of assets. Assets that were previously illiquid can easily and securely be transferred worldwide 24/7, through their digital representation.

Transactions are stored immutably and transparently on a blockchain. They are therefore securely traceable at any time. This strengthens the trust between participants in the market and eases the record keeping through distributed and descentralized ledgers.

Nowadays, more than 60% of the world’s assets are still inaccessible via traditional market infrastructure (Bloomberg). The digital transformation is nevertheless a reality, and particularly the tokenization of assets will assert as a novel financing instrument in the long term.

We understand the impact of DLT on today’s world and want to take advantage of the opportunities that it brings to create more secure and more efficient capital markets. We genuinely believe that the next generation of financial assets will be DLT /Blockchain-based. Thus, understanding the significant benefits of tokenization will be crucial to financial institutions as it will sustainably change the entire industry.