Prospectus for Tokenized Assets

It is not clear for many financial players diving into digital assets what rules they need to apply. In which cases is a prospectus required when tokenizing assets? What type of digital assets are required to publish a prospectus and who needs to approve it? In this summary, we offer an overview of the regulatory perspectives about prospectus for tokenized assets.

With the increased interest for digital representation of securities (tokens) in the crypto-asset (digital assets) market and the opportunities it involves, many jurisdictions have adopted their current legislations to meet the new types of digital assets; securities/investment tokens and utility tokens. This allows Financial Authorities to supervise the issuance and trading of the crypto market and avoid fraud, money laundering, and financing of terrorism. In addition, it makes a more robust market where investors and issuers can trust one another.

However, this is not an easy task. Governments are interested in supporting innovation, and at the same time, they must be accountable for their potential risks. Blockchain is still a novelty for legislators. In fact, in some jurisdictions, it is still banned. Yet, understanding the technology and its virtuous applications is critical for progress. And, most of the jurisdictions, including all of the major global players, have already acknowledged the importance of adopting digital assets within their capital markets.

In pursuit of the preceding, we created a summary of some of those jurisdictions that allow the issuance and trading of crypto-assets, and we think they are at the edge of building robust systems. Blockchain and other Distributed Ledger Technologies (DLT) promote liquidity, transparency, and efficiency. Offering secure and automated decentralized transactions, DLT allows for lower latency and costs. These traits made DLT one of the best tools to base a structured and inexpensive digital investment infrastructure.

The prospectus: What does the legislation say about crypto and digital assets?

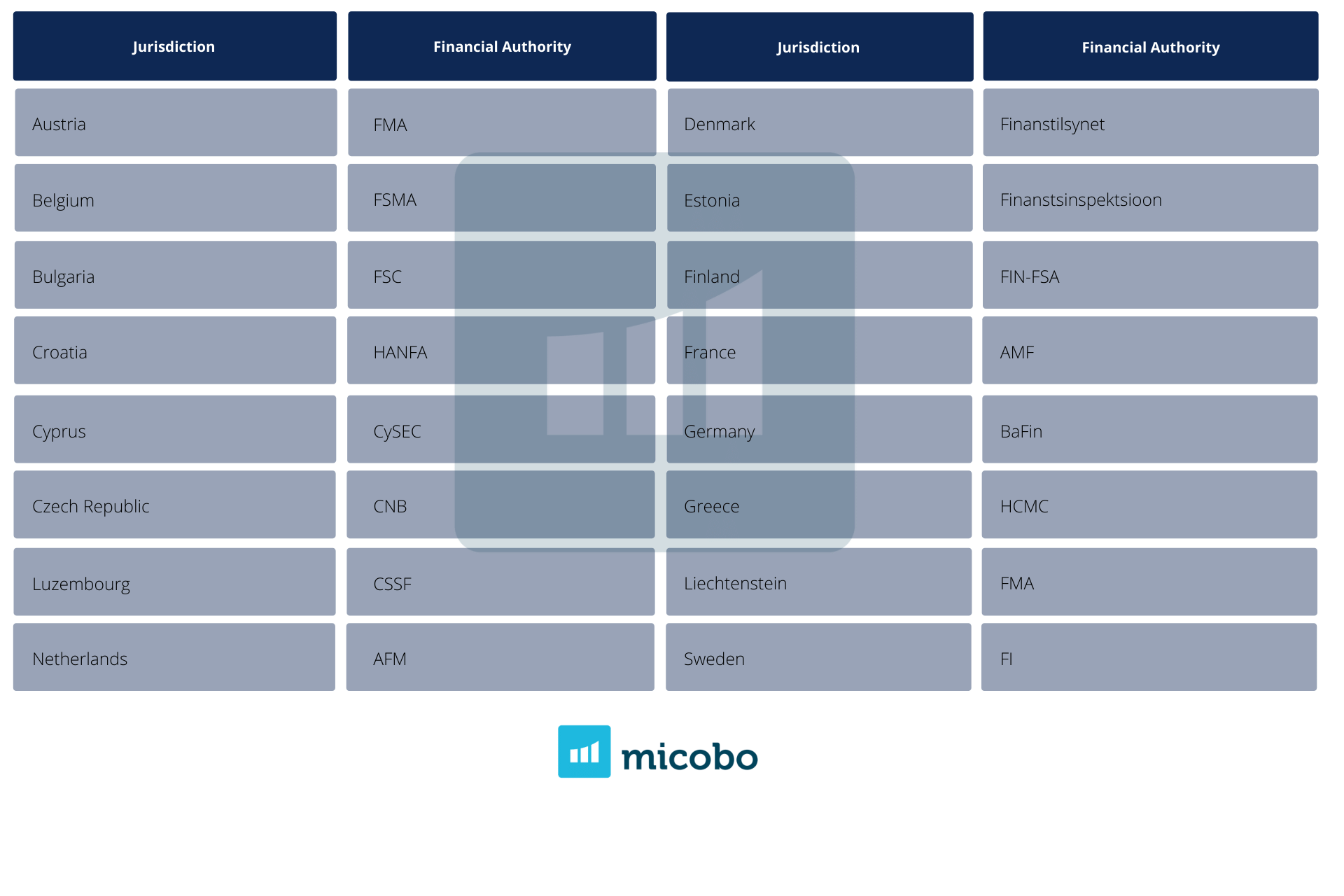

A prospectus is a formal document issued by an issuer/offeror/party seeking admission to trading/guarantor, supervised by a Financial Authority (Examples in Table 1), and presented to investors. It provides details about an investment offering to the public. A prospectus is usually used for stocks and bonds offerings, as well as mutual funds. The aim of the document is to allow investors to make informed decisions based on relevant information from the investment.

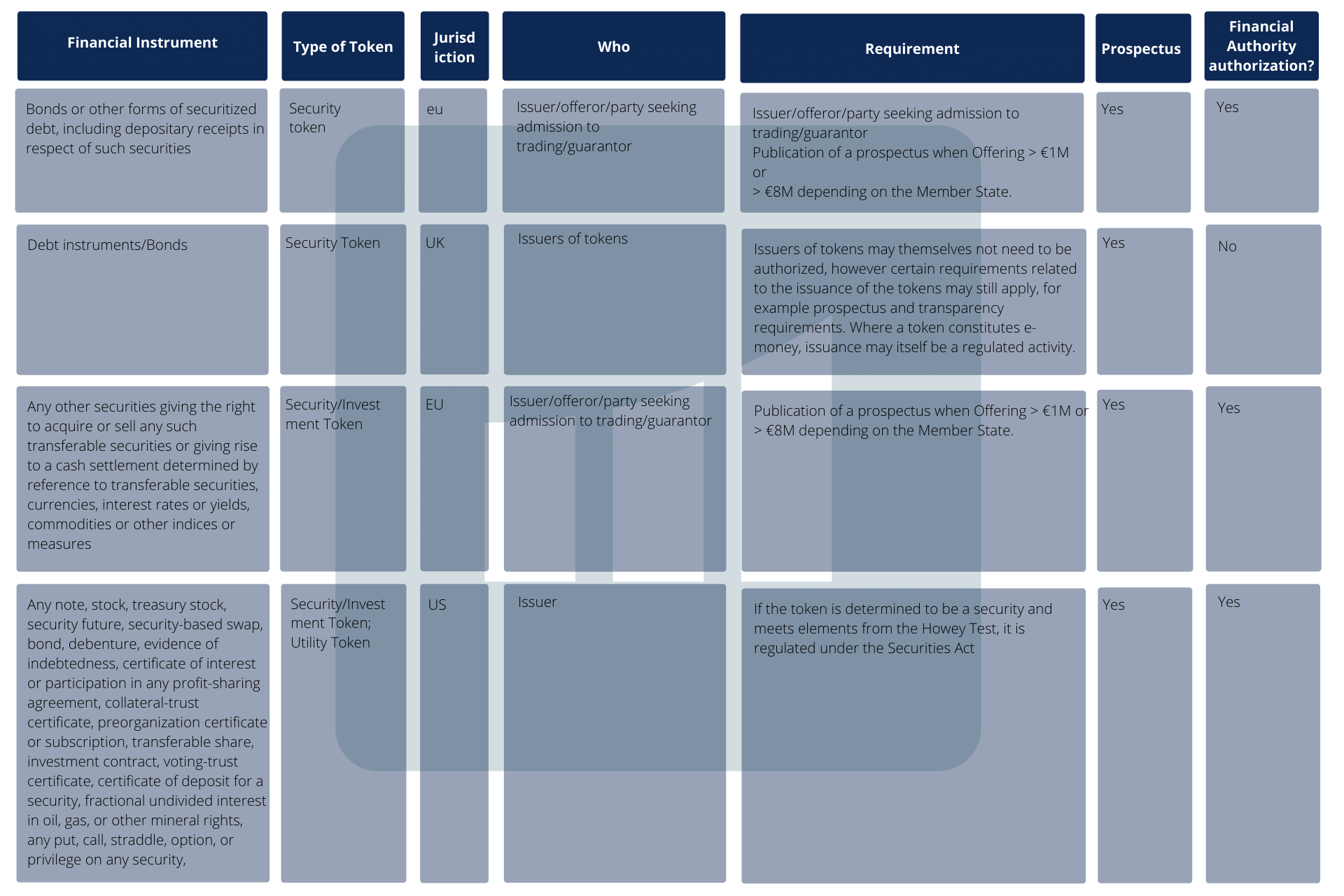

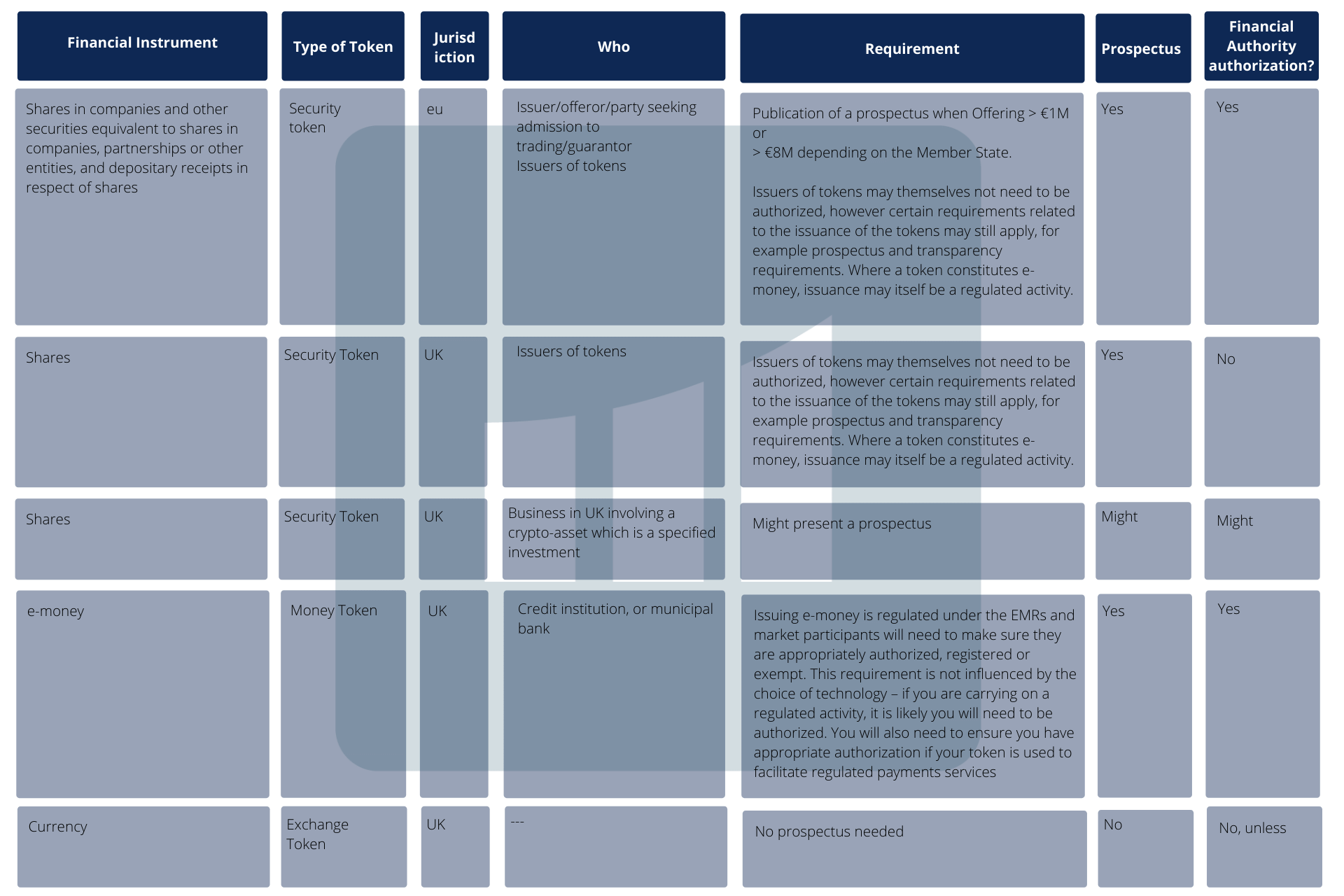

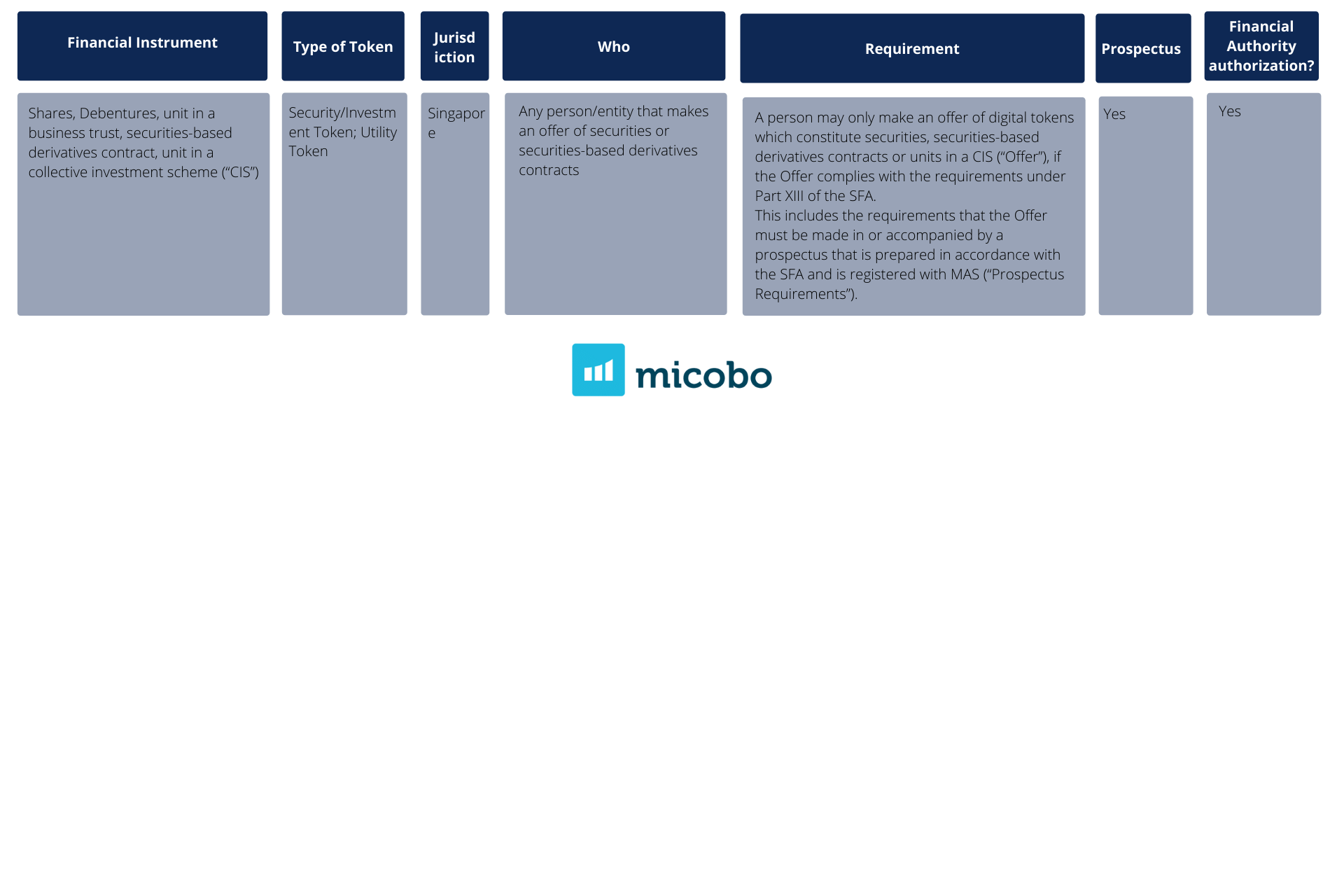

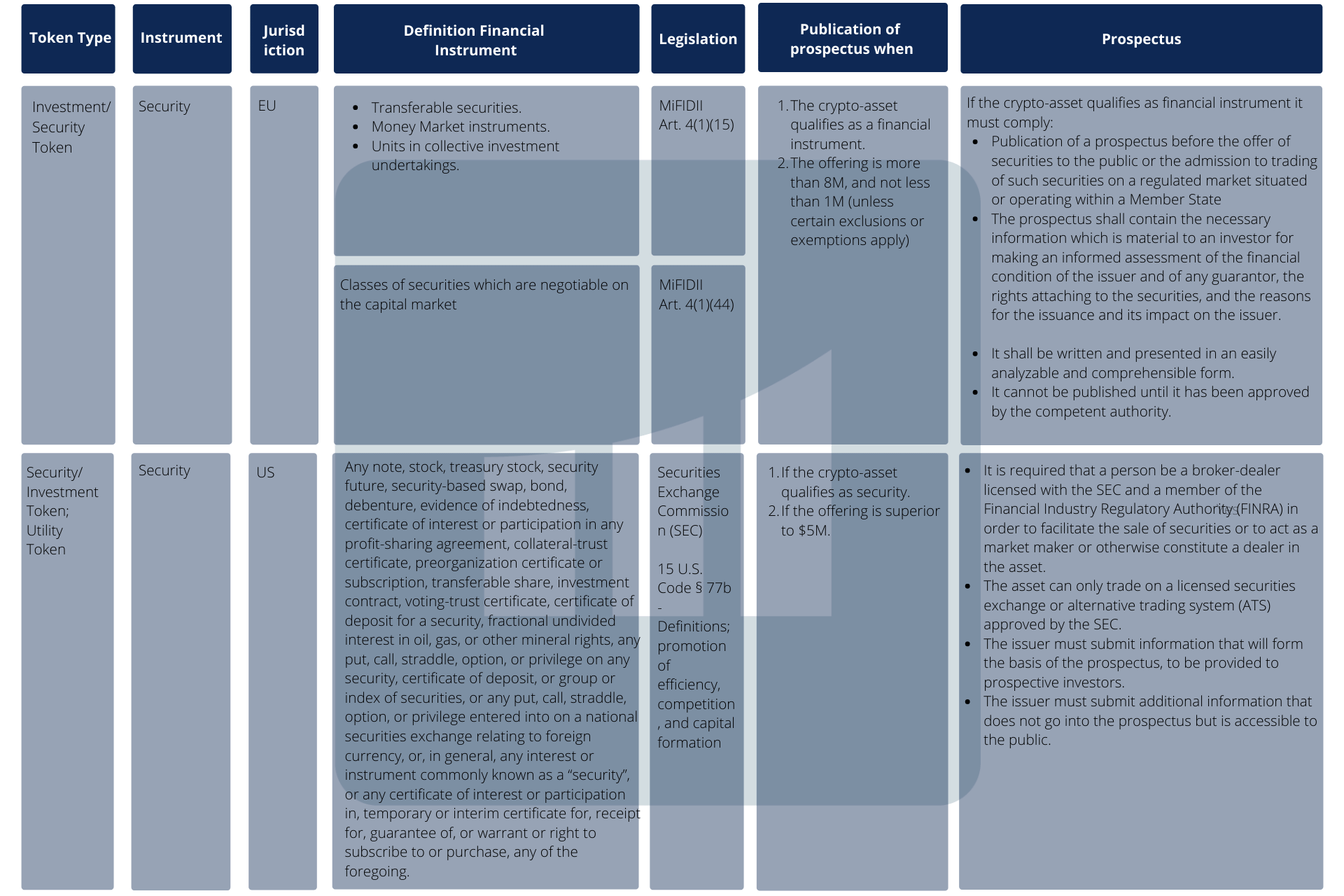

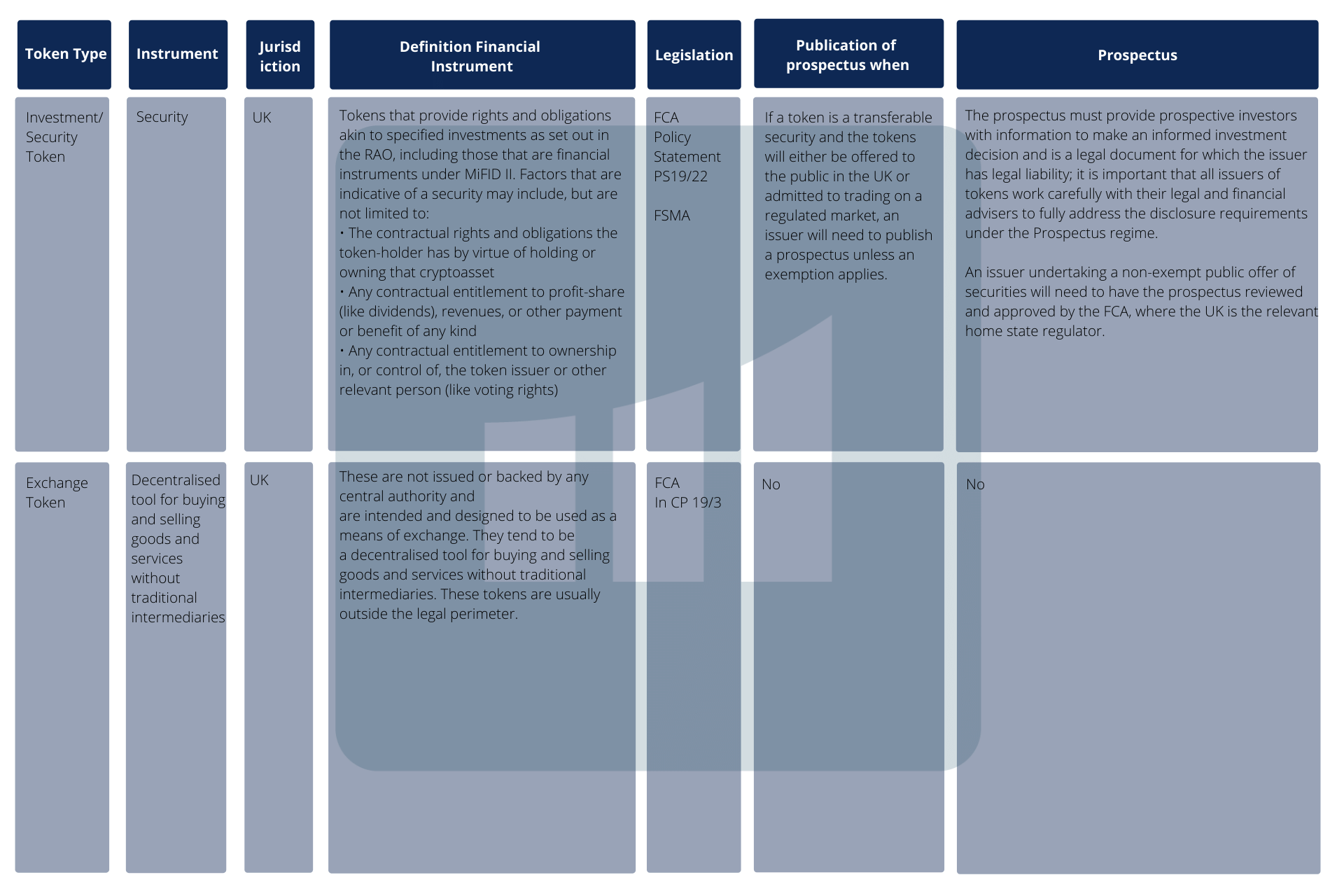

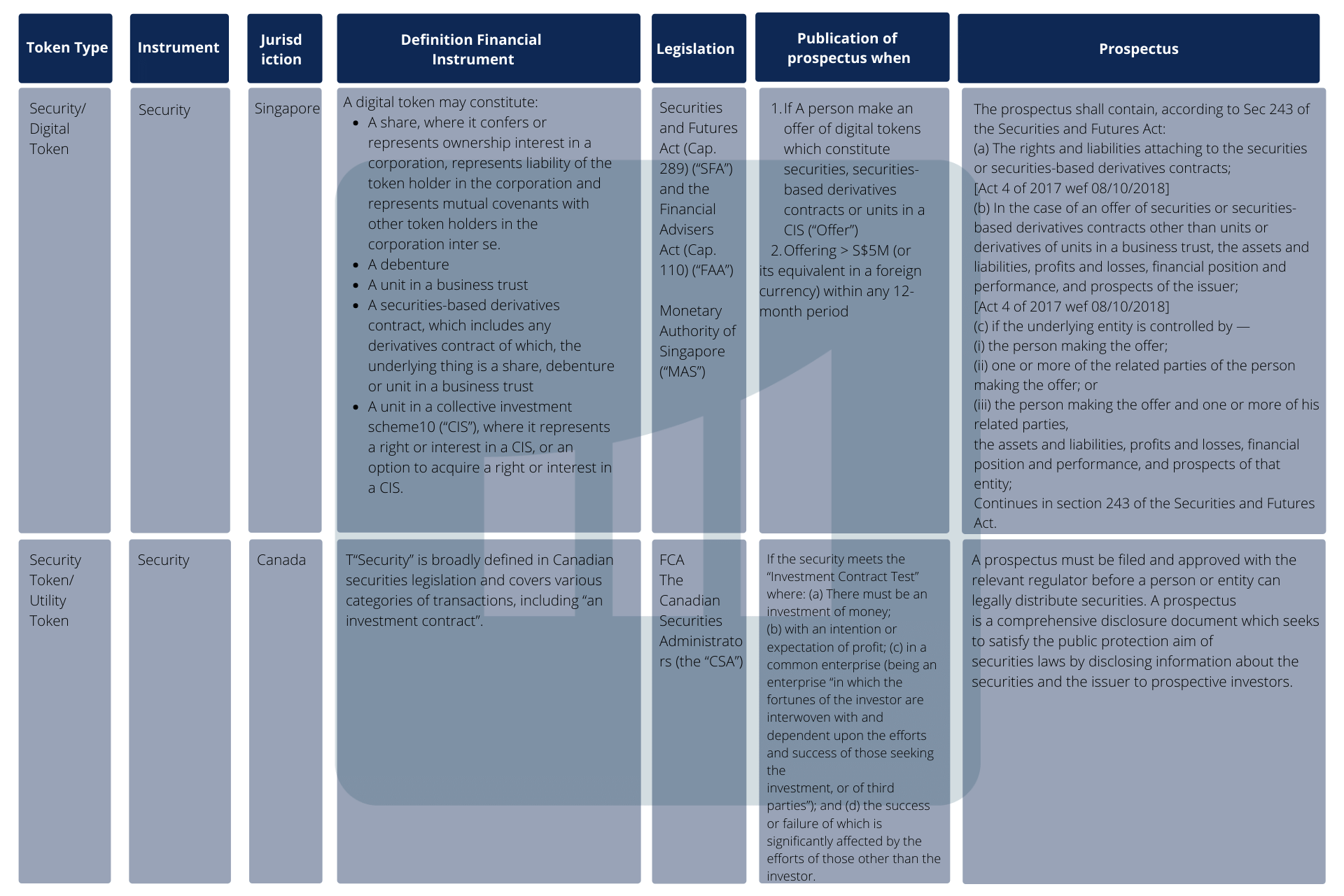

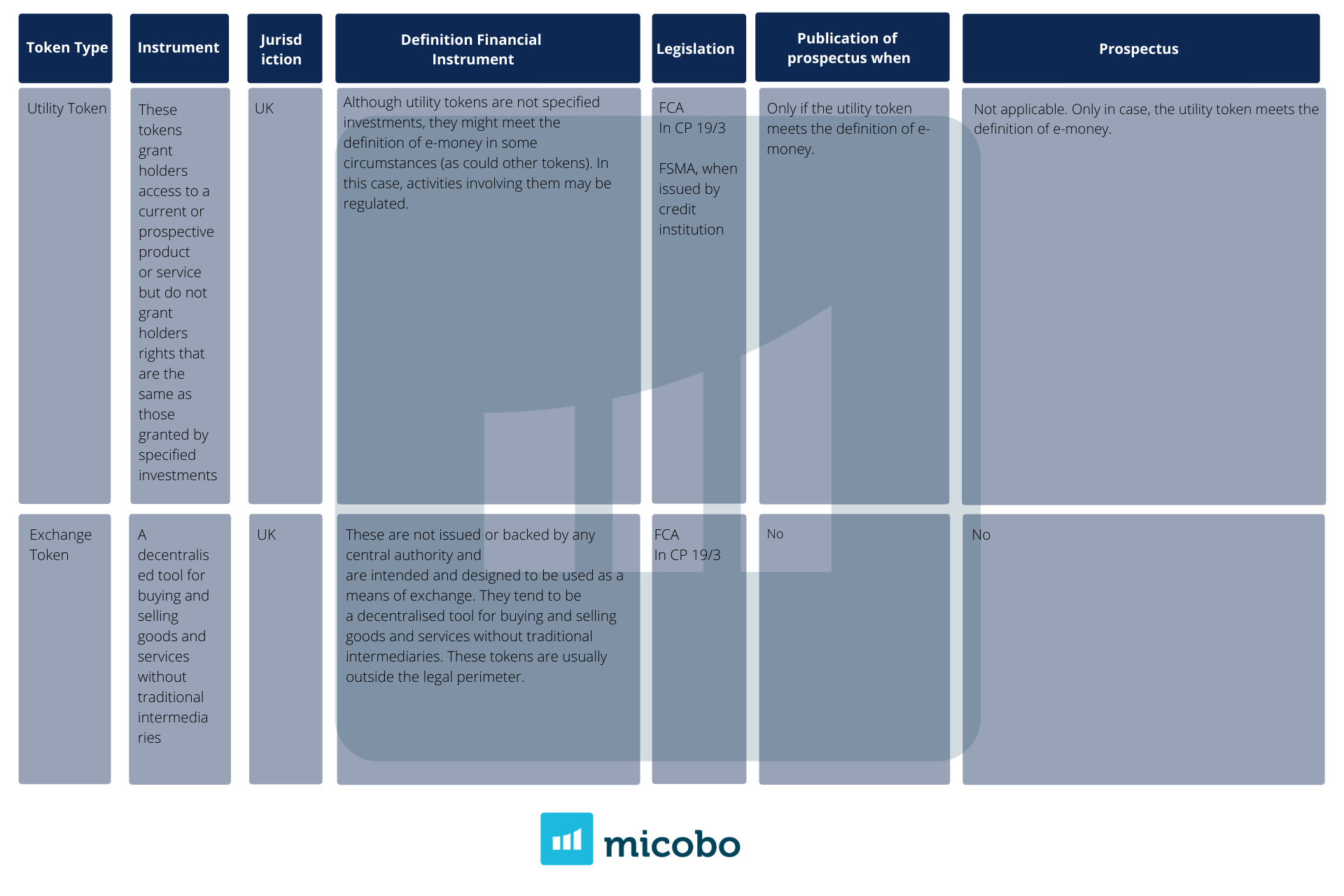

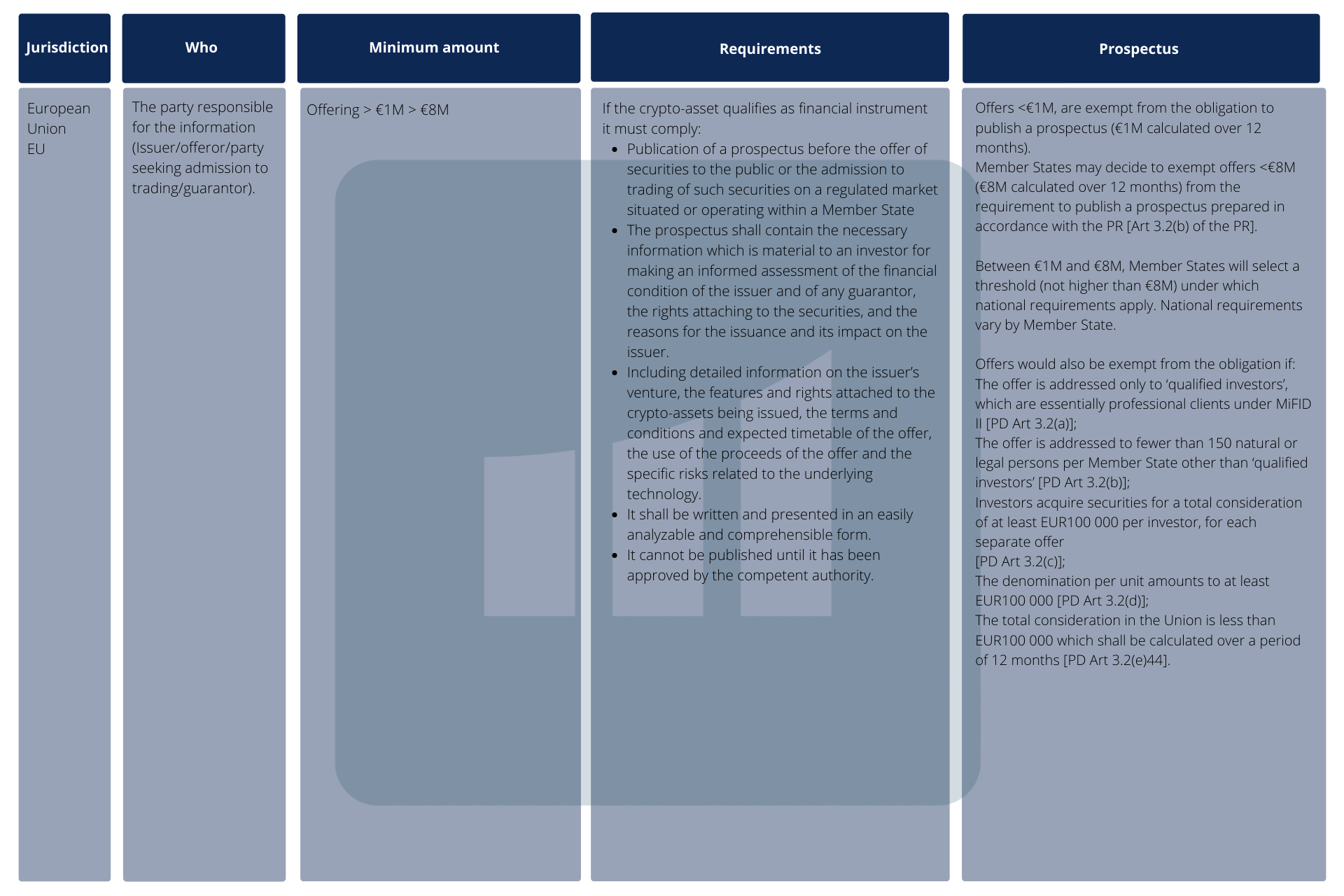

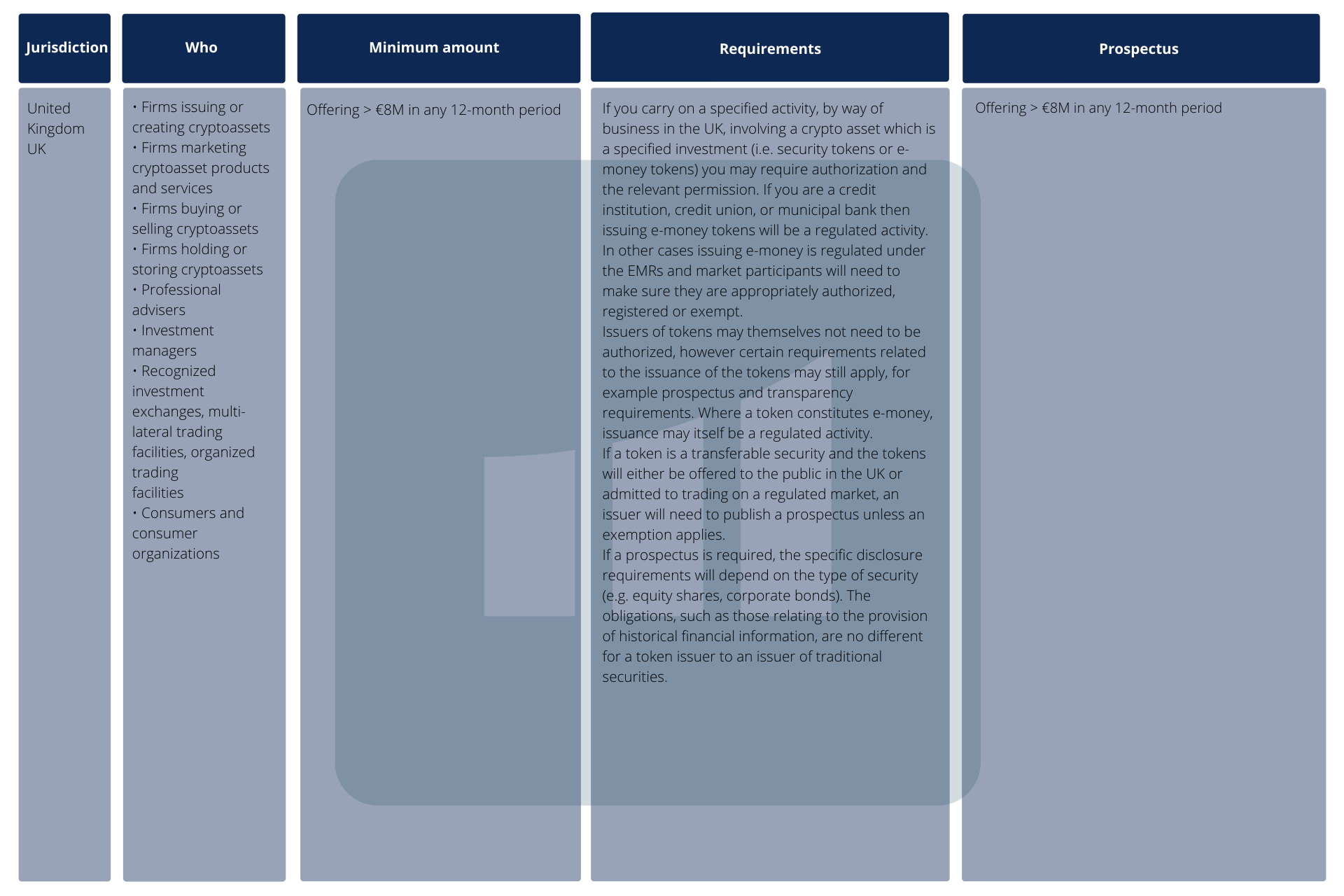

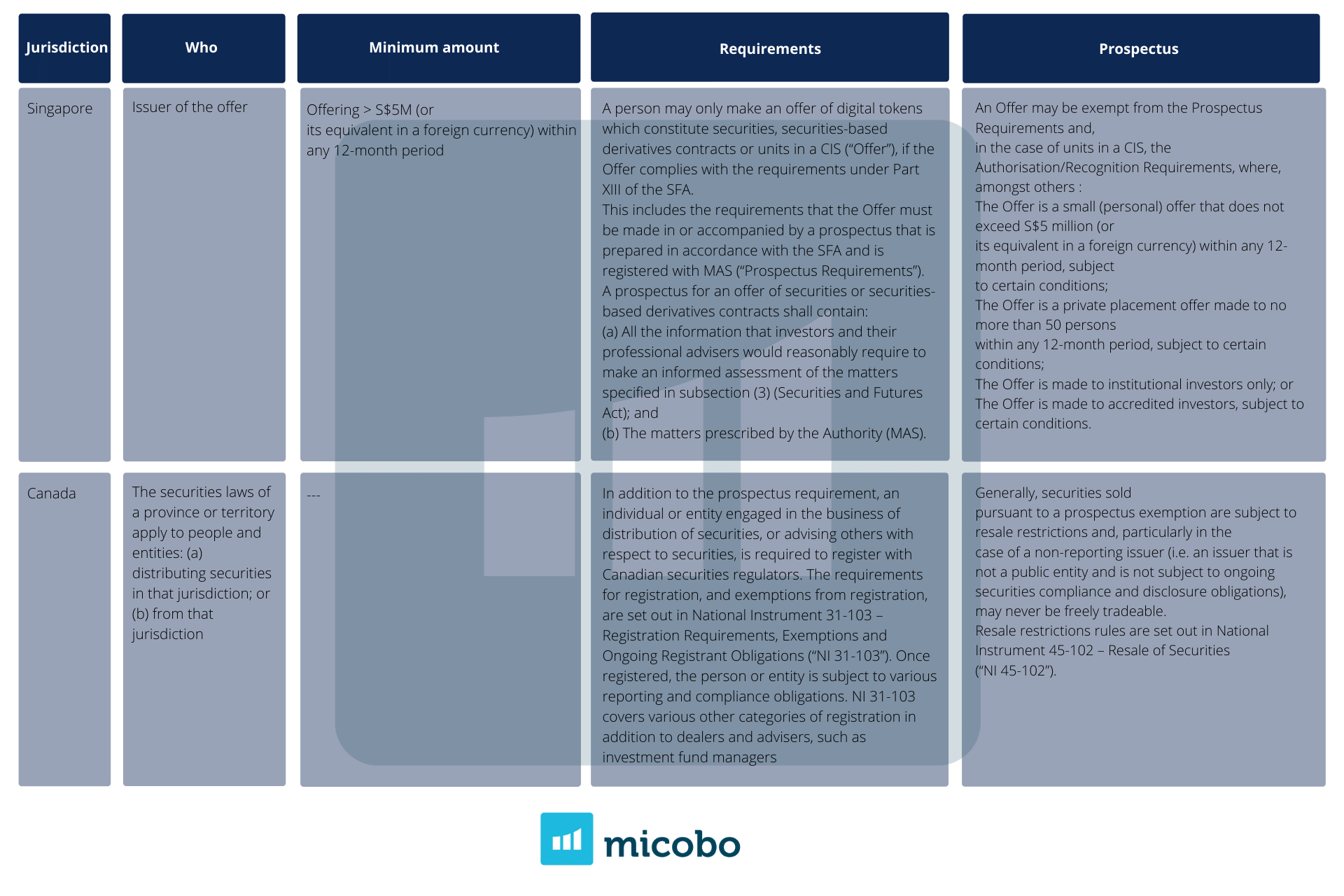

Since the introduction of security/investment tokens and utility tokens that also have features of securities, governments as the UK, Singapore, Indonesia, Canada, Germany, Switzerland, France, Australia, South Korea, South Africa, Netherlands, Thailand, US, and Japan have regulated or proposed to regulate crypto & digital assets. Most of them have adapted the current legislation on securities to DLT’s based tokens (substance over form approach). Thus, we present the main differences in terms of the issuance of the prospectus depending on the token type, the jurisdiction, and the financial instrument of the most developed crypto-asset markets; the United Kingdom, European Union, the United States, Singapore, and Canada.

Prospectus by token type

A number of regulators have issued classification frameworks for digital assets, generally token-oriented and significantly inspired by open and permissionless networks, that typically consist of three types:

- Payment/exchange tokens

- Security tokens

- Utility tokens

Prospectus by jurisdiction

Tokenized markets should comply with regulatory requirements that promote financial stability, financial consumer protection, investor protection, and market integrity while, in some jurisdictions, promoting competition.

Policymakers in different jurisdictions have approached tokenization in different ways, either by applying existing rules to tokenized assets or by introducing new tailor-made regulatory frameworks to accommodate the application of DLTs in financial services and provide regulatory clarity for specific processes/products or actors involved in asset tokenization.

Prospectus by financial instrument

As a general rule, a prospectus must be drawn up if securities are to be either offered to the public or admitted to trading on an organized market. However, prospectuses are not required if certain exemptions apply.

In particular, an investment instrument must be eligible for trading on the capital markets to be classified as a security (marketability). Securities that are fungible, or interchangeable, are eligible for trading on the capital markets. The distinction between fungible and non-fungible securities is made on the basis of whether the investment instrument can be transferred solely under property law or if it must be assigned under the law of obligations. Registered bonds, promissory note loans, GmbH shares, and limited partner shares must be transferred under the law of obligations and are therefore not securities within the meaning of the WpPG. For securities subject to a legal system outside Germany in which no distinction is made between a transfer under property law and an assignment under the law of obligations, the decisive factor is whether they can be transferred in a way that is compatible with exchange trading.

An offer to the public means a communication to the public in any form and by any means, presenting sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to purchase or subscribe to these securities.