NFTs for Unique Security Tokens

This year, Non-Fungible Tokens (NFTs) were on the front page of most media publications, thanks to the wide adoption these tokens had in the crypto financial markets. NFTs have grown in popularity until becoming a mainstream investment, from their humble beginnings as a fringe hobby. Conservatively, most of the NFTs out there may not be a great investment product. However, the technology behind the uniqueness, non-fungibility logic implicit in these tokens, can be useful for the securities markets.

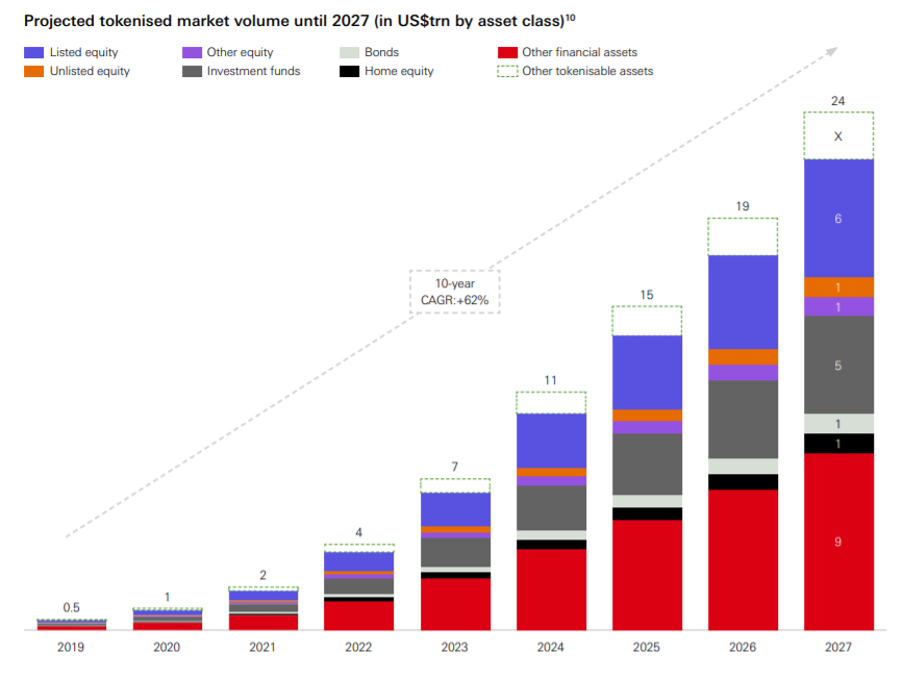

By 2025 the Security Token Market is expected to grow at 8 trillion dollars (KPMG, 2021). The increasing interest in tokenized assets, with a daily trading volume of more than 4 million dollars per day, depicts a strong and growing market. The financial services industry is adapting to Distributed Ledger Technology (DLTs) (HSBC, 2020). In fact, according to the World Economic Forum, more than 10% of the global GDP will be stored and transacted via DLTs as of 2027.

Source: HSBC (2020)

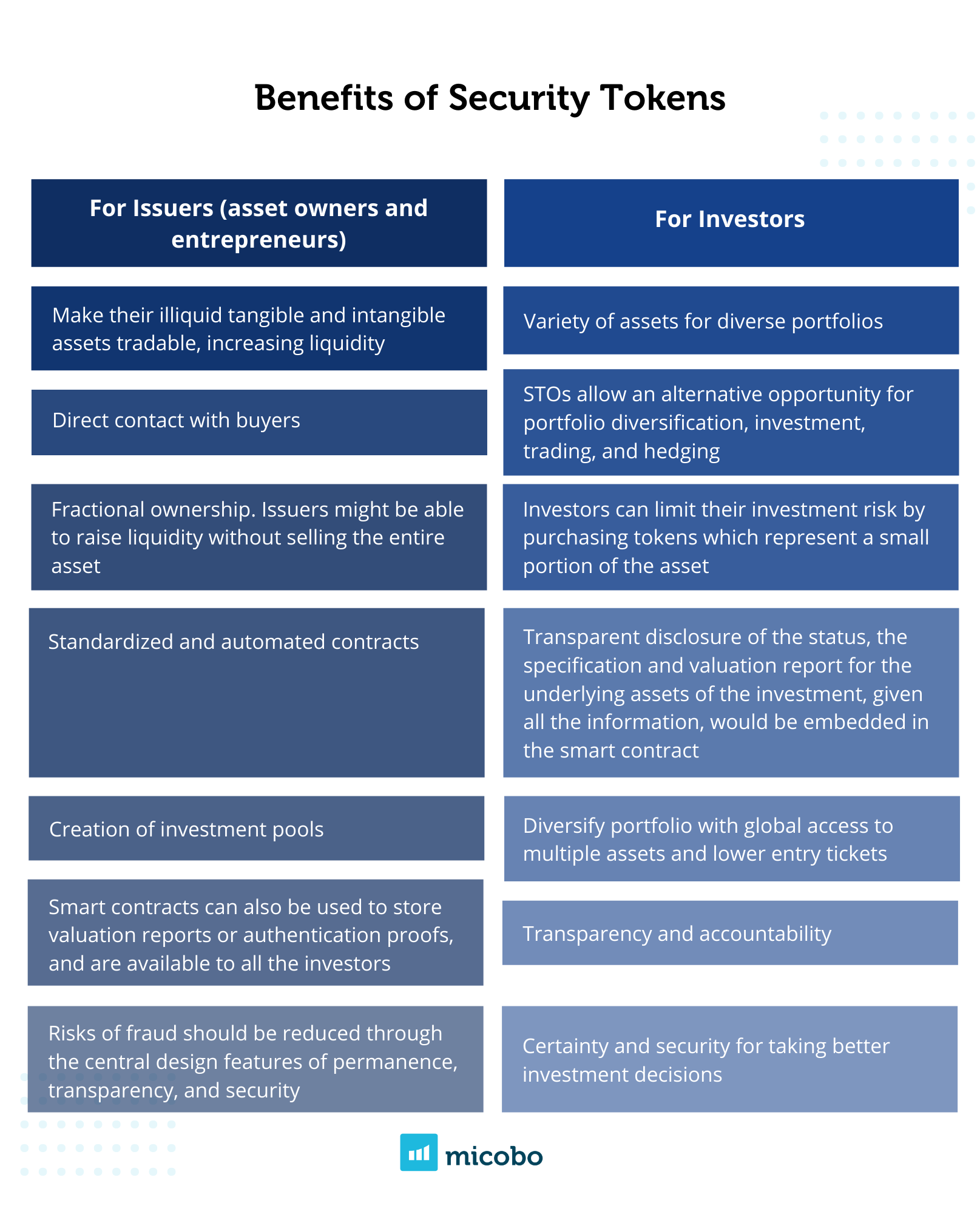

Security tokens are a digital representation of traditional tradable securities made accessible via Blockchain. They play an important role by providing transparency (records of ownership), increasing liquidity, real-time clearing and settlement, potential speed, reducing costs, provide fractional ownership which at the same time increases retail access in investment, they lower the illiquidity premia and have a moderately clear regulation that supports them (See Table 1).

Table 1. Benefits for Investors and Issuers from Security Tokens.

Security tokens provide a solution for portfolio diversification, investment, trading, and hedging. The realm of security tokens presents opportunities in every area of finance, from stocks, bonds, futures, forwards, options, real estate, and funds to helping financial institutions improve their processes. This article focuses on opportunities that have emerged from financial processes as collateral management. The analysis is divided into three different scenarios; collateral management, derivatives, and NFT’s and it highlights how, from different assets tokenization, collateral management can be enhanced.

How tokenizing assets can benefit collateral management?

In particular, collateral management is one of the financial areas that can greatly benefit from tokenization and blockchain technology. When executing repo activities for the funding of positions as well as securities lending activities as part of trading strategies, tokenization has the potential of faster and less costly securities lending, given that there are fewer intermediaries and most processes are automated on-chain. The process of transferring/unwinding collateral is direct and instantaneous (OECD, 2020).

Similarly, in the case of derivatives, the blockchain and smart contracts allow interoperability in derivatives processing by setting standardized interfaces between assets and derivatives ledgers that can decrease the manual processes as collateral settlement and allocating cross-system margin obligations. In addition, there is a reduction in data inconsistencies and communication errors. On top of that, it creates the opportunity for regulators to supervise transactions accessing shared platforms instead of requesting them.

Leaving behind the traditional collateral, there is a new form of collateral within the Blockchain, NFT’s. Most of the recent developments take digital assets as digital art, digital real estate, and collectibles to be used as collateral for borrowing ETH. The reasons range from staking or yield farming to avoiding selling an NFT asset when the owner needs a prompt source of funds (Chow, 2021). Using NFT’s as collateral improves the loan process by setting collateral less volatile than cryptocurrency and with higher growth value than stablecoins. It can expedite clearing and settlement to nearly real-time, reducing counterparty risks potentially producing capital efficiencies for participants in trades.

The following part analyses how, from different assets tokenization, collateral management can be enhanced.

1. Collateral

A collateral is an asset that backs a loan agreement. The borrower puts up collateral to guarantee the loan will be paid back. Real Estate is the most common collateral for loans, although there are other assets such as bonds, stocks, and cash (savings accounts) that can be used as collateral depending on the type of loan. Collateral reduces the risk of default, given that in case the borrower defaults, the lender can seize the collateral and sell it to recover the losses.

1.1. Which financial activities require collateral?

Financial market activities such as securities lending or repo transactions, OTC swap exposures, CCP exposures, or monetary policy refinancing operations. In general, the collateral management process defines risks against a counterparty and is expressed in a cash equivalent value that needs to be collateralized.

1.2. How can collateral management be improved?

Collateral management processes are complex, time-consuming, require broad liquidity margins, and are therefore in need of optimization. When tokenizing collateral and using DLT for collateral management purposes, many opportunities arise to improve collateral mobility and overcome existing process deficiencies such as clearing and settlement.

In order to transfer securities (marketable assets) from the collateral giver to the collateral taker, it is required the participation and intermediation of custodians and other custody-chain participants from the issuing Central Securities Depository (CSD) downwards making the process complex to manage collateral efficiently and effectively (Deutsche Bundesbank, 2020). With the use of smart contracts, collateral can be set on-chain and in case of default, the asset would be automatically sent to the collateral taker. The ledger would contain the transactions of tokenized assets that can serve as collateral.

“The use of DLT could expedite and condense trade clearing and settlement to nearly real-time, reducing counterparty risks and freeing up collateral, potentially producing capital efficiencies for participants in the trade. The post-trade multi-step process could be simplified and the back-office administrative burden lowered significantly.” (OECD, 2020)

2. Derivatives

Derivatives play a large and increasingly important role in financial markets. They can be a powerful tool for both hedging and speculation. These are securities whose prices are determined by, or “derive from,” the prices of other securities (the underlying asset as bonds, stocks, indexes, interests rates, exchange rates, commodities, among others).

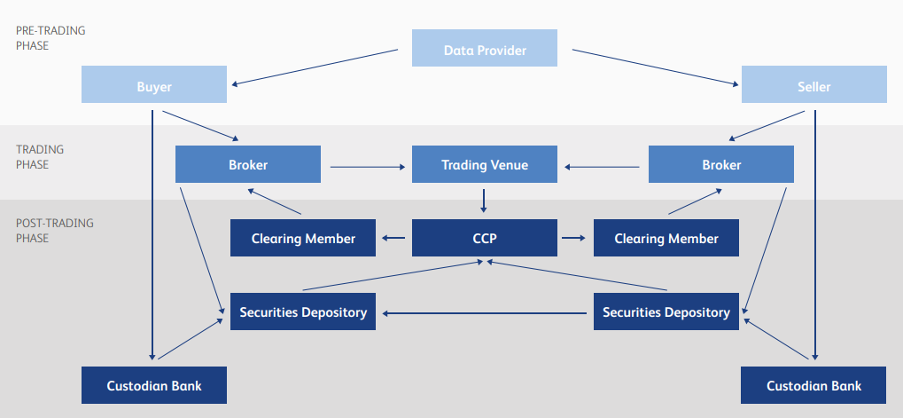

In derivatives transactions, it was important to have a clearinghouse (a middleman) that increased market transparency and reduced default risk. With blockchain, this is no longer necessary. Notaries in the interface between asset and derivatives ledger can replace the middleman function without negative implications for derivatives markets (Bearing Point, 2021).

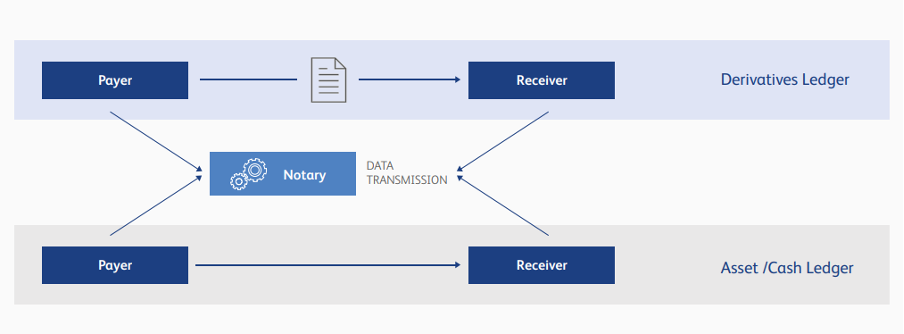

In the blockchain, two ledgers are constructed, an assets ledger and a derivatives ledger. The former contains the transactions of tokenized assets that can serve as collateral. Contractual parties store cash-like valuables and there are sub-ledgers that reflect the financial assets as bonds, stocks, treasury notes, among others. In the derivatives ledger, the contracting platform uses smart contracts to trade collateralized derivatives. Transactions are based on the account balance of the tokenized securities in the asset ledger. It requires notaries that link the two ledgers. In addition, regulators can have direct access to both ledgers in order to supervise trading. Interfaces are used to automate pending collateral requests such as initial margin calls.

The current derivatives trading structure would change, eliminating the post-trading phase shown in Figure 1.

Figure 1. Current derivative trading structure. Source: Bearing Point, 2021

Figure 2. Derivatives trading structure – Centralized DLT. Source: Bearing Point, 2021

When using a centralized distributed ledger technology, the central counterparty clearing house (CCP) acts as a notary node that combines the two ledgers (assets and derivatives) and validates that margin requirements are fulfilled and collaterals settled.

Ethereum improves the interoperability in the derivatives processing by setting standardized interfaces between assets and derivatives ledgers that can decrease the manual processes as valuing, maintaining records about ownership, and allocating cross-system margin obligations. It reduces costs due to fewer intermediaries and allows direct access to regulators. It could detect systemic risk earlier as well.

NFT’s – The unique trend

Non-fungible tokens, known as NFT’s, are tokens used to represent ownership of unique items. Non-fungible means an item cannot be exchanged by another item due to its unique properties. One NFT that represents a piece of art cannot be replicated, there is only one, the original. Each individual token is unique, scarce, and non-divisible. Most of the current examples in the market are associated with the gaming and arts industries such as collectibles for fan engagement, digital art, music, videos, tickets for events, among others. Nevertheless, there are other interesting uses, especially within regulated capital markets.

NFT’s can be used as collateral for loan agreements or more complex financial structures.

NFT holders borrow fungible assets including Ether (ETH and stablecoins) and security tokens backed with the NFTs. Being NFTs digital real estate, digital art, and digital collectibles in most examples. These loans are mostly used in staking, yield farming or to avoid having to sell an NFT asset when the owner needs a prompt source of funds (Chow, 2021).

Since NFTs have features of indivisibility (an NFT cannot be divided into multiple small NFTs), uniqueness, ownership (only one person can own an NFT), authenticity, and rarity (Gwyneth, 2021), they are not tradable as fungible tokens (as security tokens). However, marketplaces like OpenSea allow for them to be traded. And, the latest developments in NFTs have combined both standards, ERC20 (the token standard) and ERC721 (the NFT standard) to unify both worlds and allow non-fungible tokens to have the features of fungible tokens. The most important feature is the interchangeability with another asset or good for the same value. It is based on the assumption that even if NFTs are unique, there are similarities among them and they are grouped in a way that can be interchangeable.

The combination of the token standard and the NFT standard makes possible new financial structures that simulate real physical assets and processes, supporting the on-chain financial system, improving processes, reducing costs, increasing liquidity, and extending access for individual investors.

About micobo

micobo GmbH is a leading European software company for Security Token Offerings and Blockchain Software Development (DLT). It provides fully compliant software solutions for Security Token Offerings and advises on structuring DLT- and Blockchain-based Securities. micobo empowers financial institutions with state-of-the-art technology focusing on providing a better customer experience and achieving measurable results.

Author

Laura Andrade (la@micobo.com)

Bibliography

- Bearing Point. OTC-Derivatives and Distributed Ledger Technology. 2021. Retrieved from https://www.bearingpoint.com/files/OTC_Derivatives.pdf?download=0&itemId=545618. Last Accessed 05.07.2021.

- Chow, Ryan. The Theory: Financial NFTs. 2021. Retrieved from https://docs.solv.finance/solv-documentation/infrastructure/financial-nfts. Last Accessed 05.07.2021.

- Deloitte. Security token offerings: The next phase of financial market evolution?. 2020.

- Ethereum. Non-Fungible Tokens,Ethereum and NFTs . 2021. Retrieved from https://ethereum.org/en/nft/#nfts-and-defi. Last Accessed 17.10.2021.

- HSBC. The 10x potential of tokenisation. 2020. Last Accessed 17.10.2021.

- Iredale, Gwyneth. The Difference Between Fungible And Non-Fungible Tokens. 20201. Retrieved from https://101blockchains.com/fungible-vs-non-fungible-tokens/. Last Accessed 17.10.2021.

- OECD. The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series. 2020. Retreived from www.oecd.org/finance/The-Tokenisation-of-Assets-and-Potential-Implications-for-Financial-Markets.htm. Last Accessed 17.10.2021.