The legal nature of carbon markets

“Leaders made clear that climate change is a global problem. The world is welcoming in a new era of economic and political partnership with climate action at its heart. The task of the decade will be to deliver the finance, resources, and tools to rapidly deliver climate action at scale.” – UN Climate Change Conference (COP26), 2021.

In the search for limiting global temperature rise to 1.5°C and avoiding extreme weather in the coming years, global leaders are currently discussing the action plan. They have issued clear calls to continue to scale up climate finance from all sources, including delivering the $100bn per year goal stated in the Paris Agreement and intensifying efforts in the financial system. Many spoke about the pressing need for predictable and accessible finance while others raised the importance of technology development and transfer that impacts on carbon markets, and capacity building. In particular, we want to focus on two issues that impact carbon markets: the legal nature of carbon credits and offsets and the technology that can avoid double counting and fraud in emission trading systems.

Carbon Credits in Compliant Markets

Carbon markets exist as compliance markets or as voluntary markets. Compliance markets are regulated by mandatory regimes on a national, regional, or international level. To illustrate, the current market of carbon credits is led by governmental institutions from different countries of the world. Most trading exchanges are called Emission Trading Systems, which are central authorities that allocate or sell a limited number of permits for CO2 emissions. The most developed and interoperable (Borghesi, 2016) market is EU ETS which operates in all EU countries plus Norway, Iceland, and Liechtenstein (European Commission, 2021).

There are currently two main types of trading systems: “Cap and trade systems” and “baseline and credit systems”. The European Union uses the former. In a cap-and-trade system, an upper limit on emissions is predefined. These emissions are auctioned or distributed for free (OECD, 2021) according to specific criteria in a primary market. Under the baseline-and-credit system, polluters that reduce their emissions more than they are supposed to can earn credits that can be sold to those who need them in order to comply with regulations. The preceding generates an incentive to reduce emissions or to seek offsetting alternatives to comply with the law.

Carbon Offsets in voluntary markets

While carbon credit’s purpose is to exchange surplus/deficit emissions, carbon offsets offer compensation for the emissions via investing in projects that offset the CO2 and other greenhouse gas emissions. Examples range from investing in renewable energy, projects that improve energy efficiency, to planting trees and distributing cleaner cooking stoves fueled with biomass (Native Energy, 2021; 3Degrees, 2021; Carbon Checkout, 2021; myclimate, 2021, Sustainable Travel International, 2021).

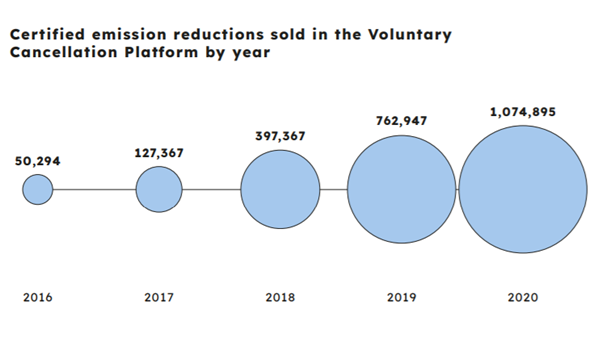

Carbon Markets can also start voluntarily due to the anticipation of stricter caps in the future (pre-compliance trading) or the voluntary attempt to reduce greenhouse gas emissions from a private company or an individual (Latimer and Maume, 2017). Voluntary markets involve a range of participants as NGOs, offsets providers and consumers. Voluntary trading schemes are innovative and propose a flexible solution for carbon offsets trading. However, the quality control has not proven to be efficient. There is evidence that purely voluntary and market-based initiatives have not led to a sufficient reduction in greenhouse gas emissions (Wittneben et al., 2012). Problems such as double counting and “green-washing” arise. This is a pressing matter due to the increase in demand for carbon offsets.

While global leaders define their commitments for 2030 in the COP26 Summit in Glasgow, it is essential that carbon markets provide an efficient solution for the reduction of greenhouse emissions which entails investing in systems/technology that avoids double counting, allows adequate price discovery, ensures market transparency and prevents manipulation and fraud. A solution like Blockchain not only solves the pressing issues but enhances the system by tracking the supply chain.

In addition, the legal infrastructure around carbon markets needs to be addressed. Many authors discuss the legal intricacies governments and private companies face (Latimer and Maume, 2017; icap,2013) such as the legal definition of the carbon credit or carbon offset and its impact on accounting, property law and tax law. For some jurisdictions carbon credits can be seen as commodities while for others they are financial instruments.

In terms of accounting, carbon allowances might be placed as an asset while by other jurisdictions it might be a liability or an investment which makes it difficult to compare among governments (at regional, national and international level), companies, or institutions.

1. What are some legal issues that carbon markets need to address?

As mentioned before, carbon markets face discrepancies that are being diagnosed by governments and law makers. One of them is related to emission allowances, which give the holder the right to emit a certain quantity of greenhouse gas emission in the context of a cap and trade system as the EU ETS. An emission allowance could be classified as a commodity or as a financial instrument.

Emission Allowances as commodities

Emission allowances could be classified as a commodity given that the traded good (in this case allowances) is a standardized, fungible (within jurisdiction) product that can be used as a factor in production (icap,2013). In addition, emission allowances have a fixed supply and its price is related to greenhouse gas emission from fossil fuel use. The price of allowances is therefore related to energy commodities markets. In fact, emission allowances are commonly traded in energy commodity exchanges as NASDAQ OMX Commodities Europe, the European Energy Exchange (EEX) or the Intercontinental Exchange (ICE). For some jurisdictions emission allowances are classified as commodities changing the commodity trading regulation, nevertheless for other jurisdictions emission allowances do not fulfill entirely the definition of commodity, for example, emission allowances are intangibles and lack of storage costs.

Emission Allowances as financial instruments

Other jurisdictions follow the definition of financial instruments. Emission allowances have a financial value and provide an investment opportunity, market participants are not limited to compliance entities and include financial intermediaries. In addition, emission allowances can be used in the derivatives market given that “In some carbon markets, because compliance (i.e. the surrendering of allowances) is only carried out once a year, some entities may decide to not hold allowances for the whole year, but rather buy outright, or enter into contracts to buy or have the option to buy allowances just before they need to submit allowances to account for their emissions” (icap,2013). Most Joint implementation (JI) and Clean Development Mechanism (CDM) credits from the Kyoto protocol are still traded as forward contracts (commonly referred to as Emission reduction Purchase Agreements- ERPA’s). Allowances, however, are an instrument created by a policy measure. Allowances are not as stocks or debt in the sense they do not give the right of ownership, or voting shares and do not represent debt of a company or country that bears interest nor are they a legal tender. According to icap (2013) emissions allowances can be seen as either a right to emit a certain amount of greenhouse gas, or a liability in that there is a fee that one has to pay when one emits a certain amount of greenhouse gas.

What about accounting in the carbon markets?

Another common issue is the legal definition of how emission allowances should be registered in accounting (Elfrink et al., 2009; FASB, 2007; Haupt and Ismer, 2011; MacKenzie, 2008). Accounting rules improve protection against money laundering and financing of terrorism, but the hybrid character of allowances as a regulatory instrument to meet compliance obligations and their very nature as a tradable instrument, makes it difficult to develop a single recognized accounting standard (icap, 2013). Gallego et al. (2016) demonstrate that firms pertaining to countries that have adopted Environmental Trading Schemes (ETS) tend to account for emission rights through provisions, investments, or as inventory. On the other side, firms that issue indicators that appear in the report drawn up by KPMG and GRI (2007) tend to account for these entries as expenses, especially as R + D expenses. Finally, firms located in countries that signed the Kyoto protocol have a tendency to not account for carbon emission rights.

What happens in the voluntary carbon markets?

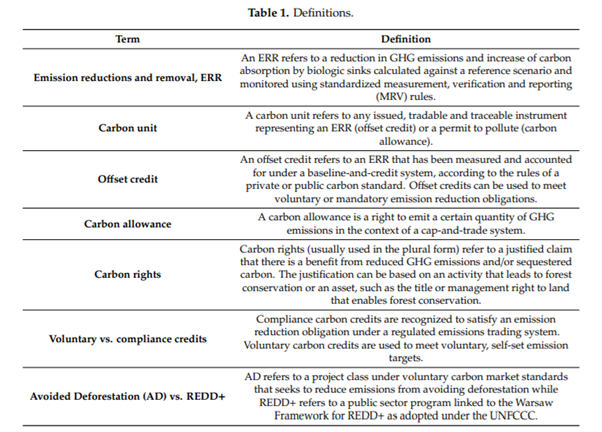

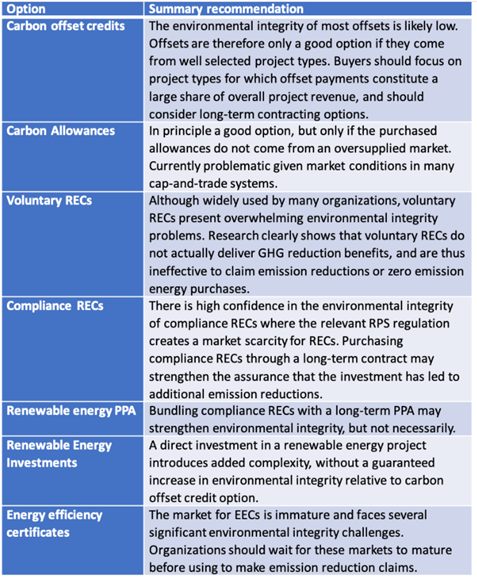

Voluntary carbon markets do not have a governance body as compliant markets. The standards (criteria) for project certification and carbon credits generation are set by private entities that have different names for their voluntary carbon credits or offsets. In the case of VERRA they are verified carbon units, for Gold Standard are carbon credits and for Plan Vivo are Plan Vivo certificates which entails difficulties in legal qualification (Malwina, 2021). In the European Union carbon allowances are classified under MiFID II as financial instruments. Some instruments from the carbon markets are summarized in Table 1 and 2.

Table 1. Definitions on carbon credit and carbon offset markets. Source: Streck (2020)

Table 2. Carbon offset instruments. Offset Guide (2020)

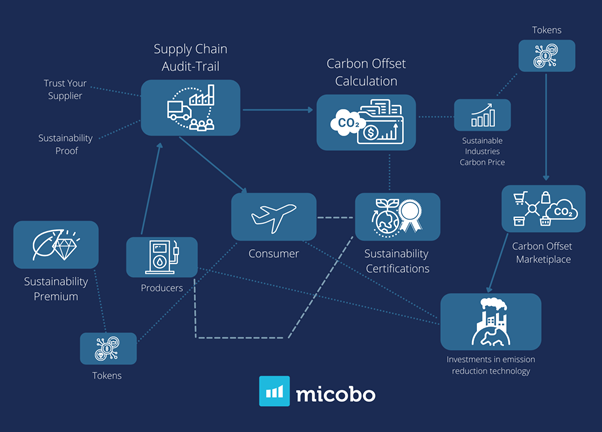

Besides the legal nature of carbon markets, it is essential for carbon markets to provide an efficient solution for the reduction of greenhouse emissions that avoids double counting, allows adequate price discovery, ensures market transparency and prevents manipulation and fraud. Tokenizing carbon credits with the help of blockchain is a useful business case since this enables a precise, tamper-proof and real-time calculation of CO2 offsets and handles the recording of production data, the supply chain.

2. Blockchain and micobo in the carbon markets

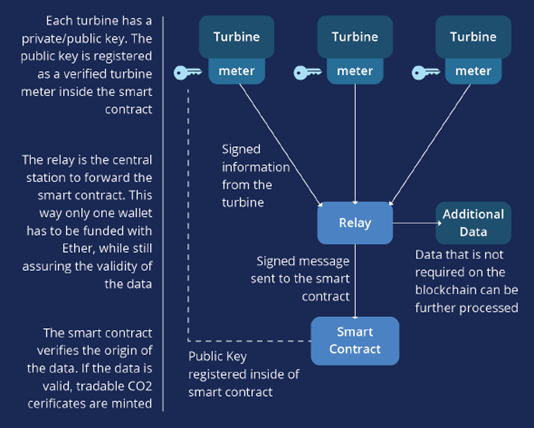

The tokenization of CO2 offset certificates is based on production data: Equipped with the Internet of Things (IoT) sensors are integrated to a blockchain-based software. micobo allocates nodes in key machines along the production chain to collect the carbon emission data.

The generated data is delivered to micobo’s blockchain solution in real time via an API (Application Programming Interface). The nodes are equipped with measurement tools to directly transfer relevant production data (produced kWh) to an Ethereum smart contract in real time using HTTPS. This enables a precise, tamper-proof and real-time calculation of CO2 savings and handles the recording of production data (feedstock, raw material, resources consumption, distribution means, etc.) automatically.

Meters are installed in the nodes to read the module’s interface and call a custom relay service. There, transactions to mint tokens representing the CO2 certificates will be sent to an ERC-20 smart contract on the Ethereum Blockchain.

The smart contract will issue the corresponding amount of carbon offset credits in form of ERC-20 Tokens and capture all relevant production data on-chain, ensuring the accuracy of the emissions’ reduction. Thanks to the immutability of the data kept on the blockchain that triggers the issuing of the tokens, this solution hindrance the possibility of double-spend certificates.

Figure 1. Technical Architecture. Source: micobo, 2021.

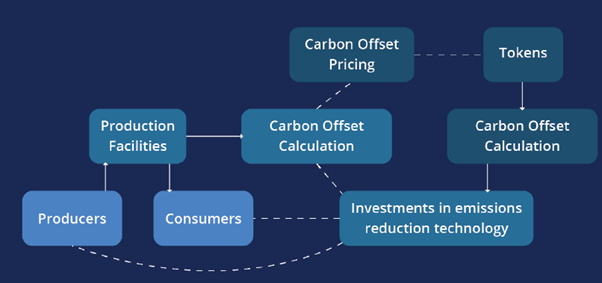

The generated Tokens will be minted into the low-emitter/neutral-emitter producers’ wallet and can be transferred from there to clients and buyers of these carbon credits.

The solution is equipped with a Decentralized Application (DApp), that operates for authenticated users through an intuitive and user-friendly WebApp. This solution allows for multi-stakeholder participation, supporting a marketplace for carbon offset credits (tokens). This carbon marketplace connects unused emission allowances with demanding producers on a global scale: Allowing borderless transactions to compensate for carbon emissions based on verifiable emissions’ reduction.

Micobo’s tokenization solution digitalizes carbon offset credits into fungible and tradable securities with transparent pricing and real-time settlement/trading. Employing the carbon footprint accounting formula embedded in the smart contracts (following the EU RED Model as an internationally accepted standard), the tokens can be traded between the authenticated stakeholders and/or the white-listed investors.

The DApp enables investors and stakeholders (supply chain participants) to monitor their investment and emissions’ allowances 24/7 in real-time. The resulting increase in tokens and other production and emission information can be observed on a dashboard. A login will be necessary to access it (stakeholders / tokenholders).

Figure 2. micobo carbon (offset) credit solution. Source: micobo, 2021

About micobo

micobo GmbH is a leading European software company for Security Token Offerings and Blockchain Software Development (DLT). It provides fully compliant software solutions for Security Token Offerings and advises on structuring DLT- and Blockchain-based Securities. micobo empower financial institutions with state-of-the-art technology focusing on providing a better customer experience and achieving measurable results.

micobo’s solution eliminates redundant verification processes and redundant information registered in isolated databases using distributed ledgers. It uses proven and a fully compliant set-up, adaptable to the customer’s needs.

Author

Laura Andrade (la@micobo.com)

Bibliography

- Borghesi, Simone. The Best (and Worst) of GHG Emission Trading Systems: Comparing the EU ETS with Its Followers. 2016. Retrieved from https://www.frontiersin.org/articles/10.3389/fenrg.2016.00027/full. Last Accessed 08.11.2021.

- Burzec, Malwina and Kasia Klaczyńska. Voluntary Carbon Market: Challenges and Promises of the Green Transition Tool. EY. 2021. Retrieved from https://www.ey.com/en_pl/law/voluntary-carbon-market. Last Accessed 08.11.2021.

- European Commission. EU Emissions Trading System (EU ETS). 2021. Retrieved from https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en. Last Accessed 08.11.2021.

- Gallego-Alvarez, Isabel, Jennifer Martínez-Ferrero and Beatriz Cuadrado-Ballesteros. Accounting Treatment for Carbon Emission Rights. 2016.

- icap. Carbon Market Oversight Primer. 2013. Retrieved from https://icapcarbonaction.com/en/?option=com_attach&task=download&id=257. Last Accessed 08.11.2021.

- Latimer, Paul and Philipp Maume. Carbon Market Organization: Markets and Laws. 2017. Research Gate.

- Streck, Charlotte. Who Owns REDD+? Carbon Markets, Carbon Rights and Entitlements to REDD+ Finance .2020. Retrieved from https://www.mdpi.com/1999-4907/11/9/959. Last Accessed 08.11.2021.

- UN Climate Change Conference UK 2021. COP26 WORLD LEADERS SUMMIT- PRESIDENCY SUMMARY. Retrieved from https://ukcop26.org/cop26-world-leaders-summit-presidency-summary/. Last Accessed 08.11.2021.

- UNFCCC. Annual Report 2020. 2020. Retrieved from https://unfccc.int/sites/default/files/resource/UNFCCC_Annual_Report_2020.pdf. Last Accessed 08.11.2021.