Crypto 2.0: Rollups

The importance of scalable blockchains increased when global corporations started embracing the technology to save costs (potentially billions of dollars), therefore improving business processes and increasing transparency. Currently, CME Group, Coinbase, Stone Ridge, State Farm, Signature Bank, Pay Pal, and many others use Ethereum and other Blockchains to make transactions gaining a leading position in the future of digital assets. Hence, corporations are directly affected by Ethereum and other blockchain updates in security, scalability, performance, and usability.

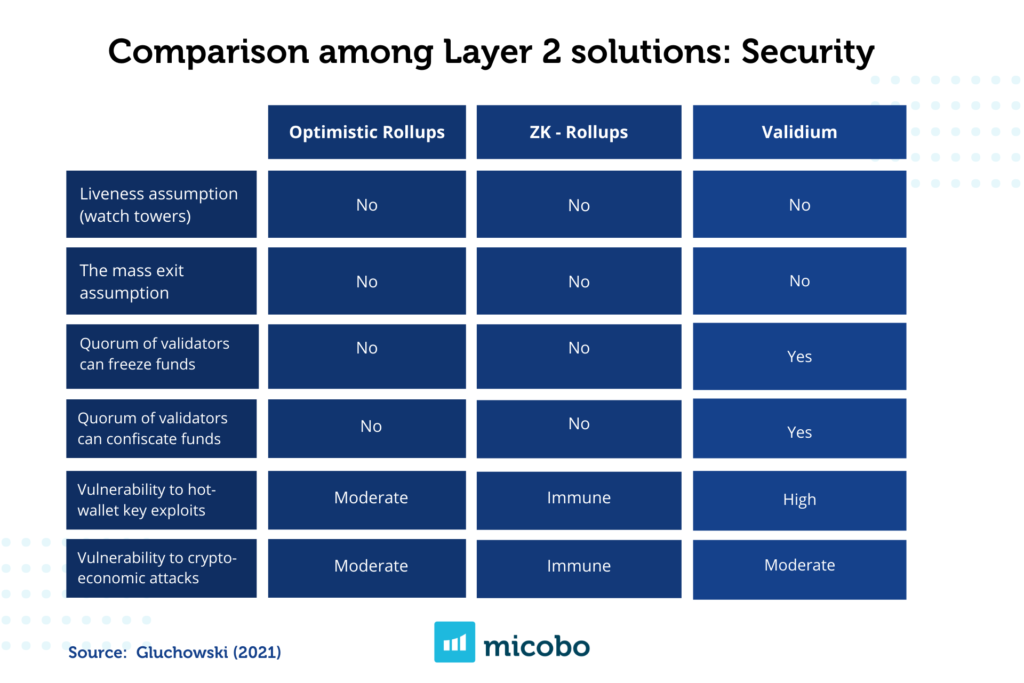

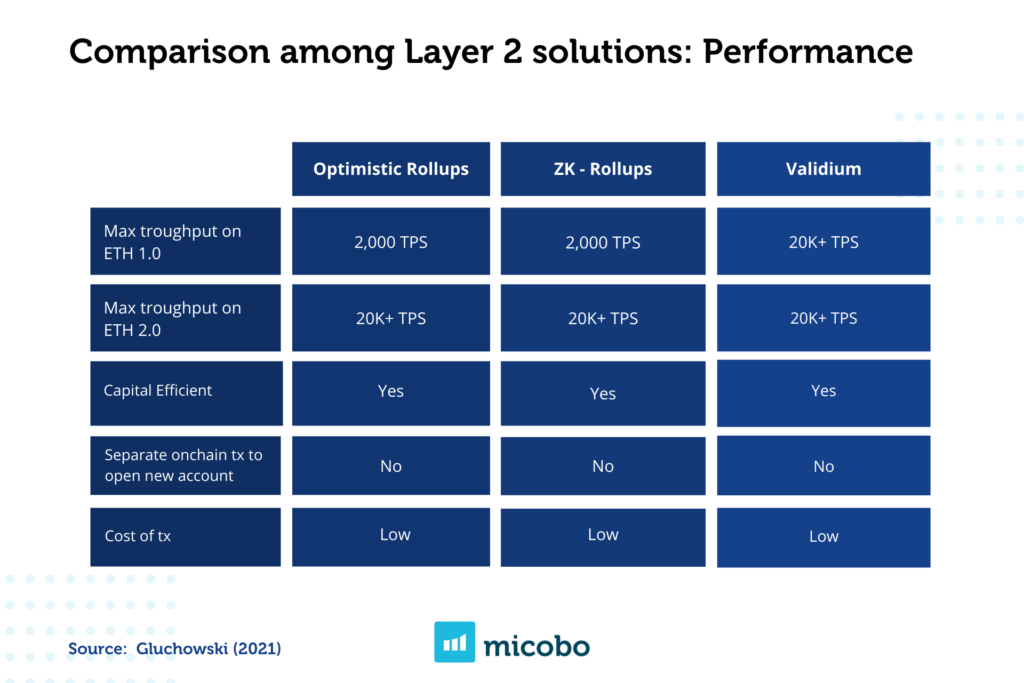

Focusing on Ethereum scalability, we already know that efforts are being made through Ethereum 2.0 increasing throughput from 15 transactions per second (TPS) to 2,000 – 4,000 TPS. Alternative solutions to scalability as rollups have come to play an important role in the crypto market given that they offer better security conditions in comparison with other Layer 2 solutions such as state channels, plasma, and sidechains (Gluchowski, 2021). In addition, they make a great fit for high-volume transaction businesses. To illustrate, zero-knowledge rollups (zk) promises to reduce native withdrawal times of any asset from 1 week to 1-10 minutes, which at simple sight might not be much if the volume is low, however, this difference for a professional trader would significantly improve her/his margin.

This article analyzes the differences between optimistic rollups and zero-knowledge rollups and showcases its main providers.

Rollups

Rollups are a general-purpose scaling solution that relies on Ethereum security with the advantage of deploying all of the existing smart contracts without sacrificing security and with little or no changes. It basically can execute transactions in the rollup, takes the data, compresses it, and rolls it up to the Ethereum mainchain in a single batch, meaning it moves computation off-chain allowing more transactions to be processed.

Optimistic Rollups

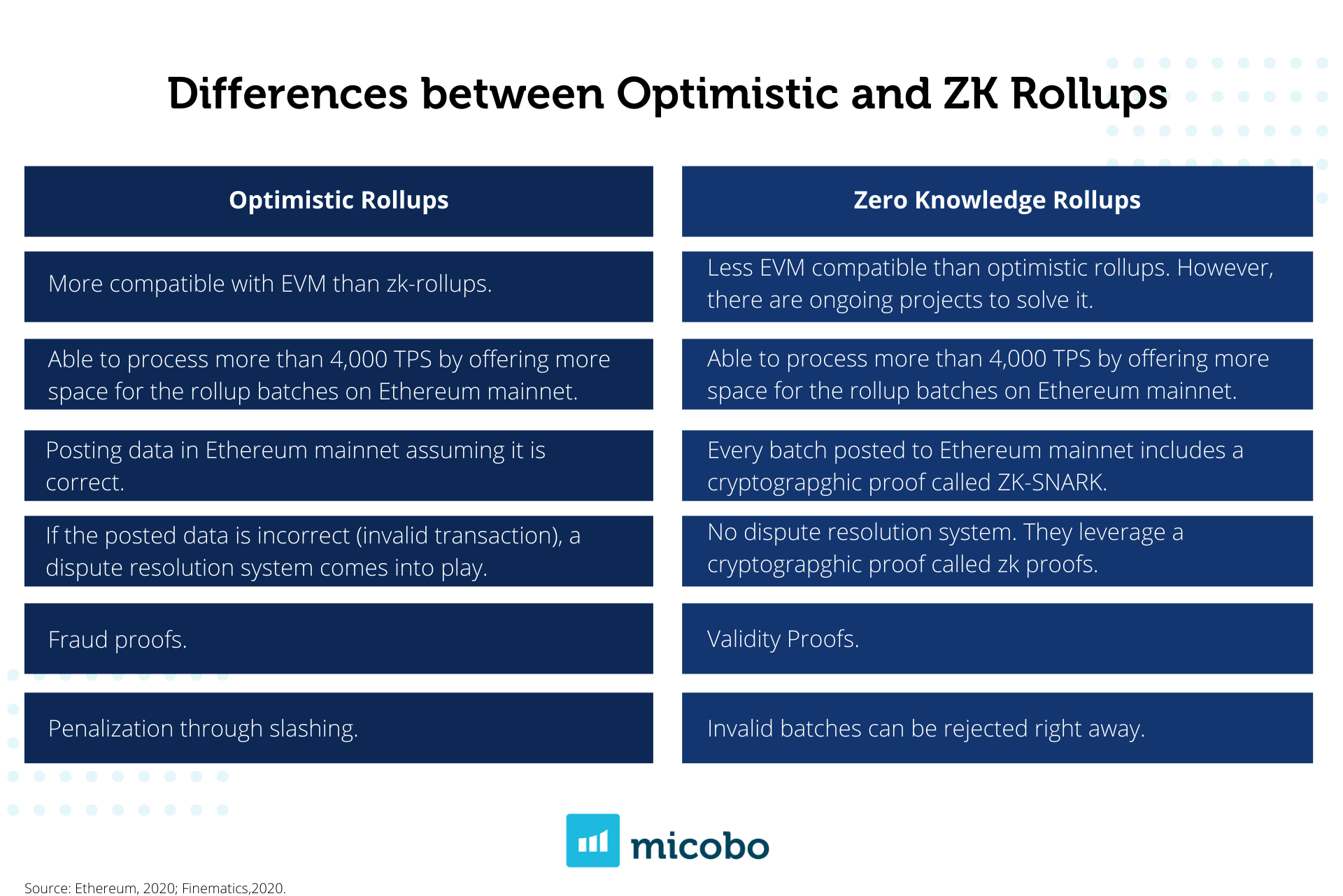

There are two types of rollups, optimistic and zero-knowledge rollups. They differ from each other in the security protocols and their compatibility with the Ethereum Virtual Machine (EVM). Optimistic rollups post data in layer 1 (Ethereum) assuming it is correct. If the posted data is incorrect (invalid transaction), a dispute resolution system comes into play.

The dispute system verifies fraud proofs, detects fraudulent transactions, and disincentivizes bad actors by penalizing them (slashing ETH). If the posted data is correct no additional steps are needed. To be able to execute a rollup transaction on layer 1, optimistic rollups implement a system that is able to replay a transaction with the exact state that was present when the transaction was originally executed on the rollup. The system can detect fraud even if there is only 1 honest party that monitors the state of the rollup and submits fraud proofs if needed. Optimistic rollups are more EVM compatible than ZK-rollups, in fact, more than 99% of optimistic rollups contracts can be ported without making any changes. It is much harder to create an EVM compatible ZK-rollups due to the complexity of the technology which makes it difficult to scale general purpose applications.

Zero-Knowledge Rollups

ZK-Rollups does not have a dispute resolution system. Instead, every batch posted in the Ethereum mainnet includes a cryptographic proof called ZK-SNARK. The proof is quickly verified by the Ethereum contract when the transaction batch is submitted and invalid batches can be rejected instantly. This is generally called ‘validity proof’. As opposed to optimistic rollups, ZK rollups do not have long waiting times for withdrawals. However, zk-rollups are more computation heavy given that nodes that compute zk-proofs have to be high-spec machines making it hard for users to run them. This, without compromising the sustainability of Ethereum (Wintermeyer, 2022). In the near future, the community is expecting a ZK-rollup solution compatible with EVM. Some advanced projects are led by ZKSync, with their ZK-EVM solution.

In terms of performance, rollups have very similar results, being zk-rollups cheaper than optimism rollups because it requires the least amount of data to be posted on-chain (no signatures and no transaction parameters) (zkSync, 2022).

In terms of usability and user experience, zk-rollups are better due to reduced waiting times for withdrawals. Any withdrawal is finalized between 15 minutes and 3 hours as opposed to 1 week when using optimistic rollups.

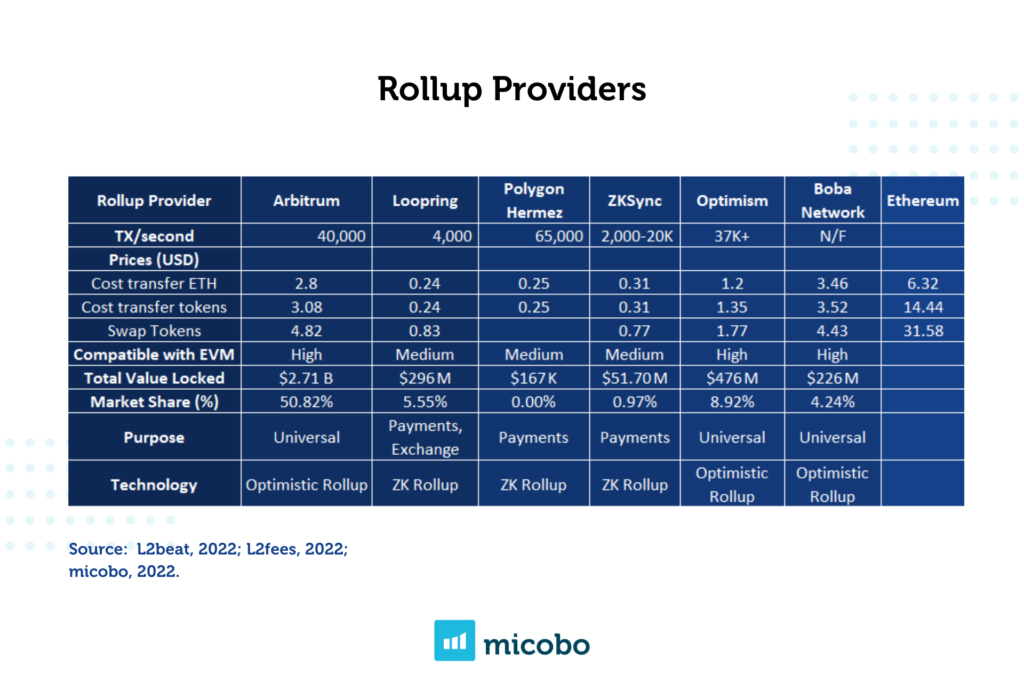

Rollup Providers

Currently, the top layer 2 providers in terms of total value locked (TVL) are Arbitrum, dYdX, Optimism, Metis Andromeda, Loopring, Boba Network, ImmutableX, ZKSwap V2, DeversiFi, and zkSync, being Arbitrum the provider with the greatest market share. In the following figure, there is a summary of the most popular rollups solutions focusing on costs and financial features.

About micobo

micobo GmbH is a leading European software company for Security Token Offerings and Blockchain Software Development (DLT). It provides fully compliant software solutions for Security Token Offerings and advises on structuring DLT- and Blockchain-based Securities. micobo empowers financial institutions with state-of-the-art technology focusing on providing a better customer experience and achieving measurable results.

Author

Bibliography

- Ethereum. Layer 2 Rollups. 2021. Retrieved from https://ethereum.org/en/developers/docs/scaling/layer-2-rollups/. Last Accessed 12.01.2022.

- Ethereum. Plasma chains. 2021a. Retrieved from https://ethereum.org/en/developers/docs/scaling/plasma/. Last Accessed 12.01.2022.

- Ethereum. Plasma chains. 2022. Retrieved from https://ethereum.org/en/developers/docs/scaling/sidechains/. Last Accessed 12.01.2022.

- Ethereum. State Channels. 2022a. Retrieved from https://ethereum.org/en/developers/docs/scaling/state-channels/. Last Accessed 12.01.2022.

- Ethereum. A rollup-centric ethereum roadmap. 2020. Retrieved from https://ethereum-magicians.org/t/a-rollup-centric-ethereum-roadmap/4698. Last Accessed 12.01.2022.

- Finematics. Ethereum Layer 2 Scaling Explained. 2020. Retrieved from https://finematics.com/ethereum-layer-2-scaling-explained/. Last Accessed 12.01.2022.

- Forbes. Blockchain 50 2021. 2021. Retrieved from https://www.forbes.com/sites/michaeldelcastillo/2021/02/02/blockchain-50/?sh=4043e2fc231c. Last Accessed 27.01.2022.

- Forbes. Are ZK-Rollups The Last Piece Of Blockchain’s Scaling Solution Puzzle?. 2022. Retrieved from https://www.forbes.com/sites/lawrencewintermeyer/2022/01/20/are-zk-rollups-the-last-piece-of-blockchains-scaling-solution-puzzle/. Last Accessed 27.01.2022.

- Gluchowski, Alex. Evaluating Ethereum L2 Scaling Solutions: A Comparison Framework. Matter Labs. 2021. Retrieved from https://blog.matter-labs.io/evaluating-ethereum-l2-scaling-solutions-a-comparison-framework-b6b2f410f955. Last Accessed 17.01.2022.

- L2Beat. Finances and Risks. 2022. Retrieved from https://l2beat.com/. Last Accessed 12.01.2022.

- Loopring. Loopring offers. 2022. Retrieved from https://loopring.io/#/https://www.coindesk.com/learn/polygon-and-matic-whats-the-difference/. Last Accessed 12.01.2022.

- Statista. Visa, MasterCard, UnionPay transaction volume worldwide 2014-2020. 2022. Retrieved from https://www.statista.com/statistics/261327/number-of-per-card-credit-card-transactions-worldwide-by-brand-as-of-2011/. Last Accessed 12.01.2022.

- zkSync. zkEVM FAQ. 2022. Retrieved from https://zksync.io/zkevm/#how-scalable-is-a-zk-rollup. Last Accessed 12.01.2022.