On Ethereum Sustainability

“Ethereum is outperforming Bitcoin” is the new headline from CNBC (2021), the business and financial news network. With less than half the market capitalization of Bitcoin, Ethereum had a trading volume of 600 billion dollars in May 2021, 60% higher than Bitcoin, according to Morgan Stanley. With the new updates expected for 2021 and 2022, Ethereum promises to be the leading data and logic processor, transaction validator with distributed storage in the crypto market, adding to its consensus protocol the sustainable development goals (SDGs).

Nowadays, the pressing apprehension amid the climate crisis has pushed the markets towards sustainable targets seeking to improve their environmental-friendly practices. With this, the negative environmental impact of cryptocurrencies such as Bitcoin has been widely covered in the press in recent weeks and months, flagged as a cause for concern.

Although cryptocurrencies have been recently involved in this unease, what should be analyzed is the technology behind them and what it enables. Blockchains and other Distributed Ledger Technologies (DLT) have the potential to drive positive impact at an immense scale. A portion of this potential lies in the alignment of network value creation through participation. Unlike centralized networks, where a minimal number of shareholders control and benefit from the network’s growth, blockchain enables an incentive system that can benefit the entire network.

This also adds greater transparency. Through distributed networks, every transaction is validated by multiple parties, ensuring that no participant can alter the data without informing the entire network. Unlike big tech’s algorithms, which are kept secret and are constantly changing, blockchain’s contracts as well as their standards and governing logics, are public (open-sourced) —at least the case of Ethereum, the most used blockchain in the world—.

That is why this tamper-proof, transparent technology that has earned its reputation as “the trust machine” is being increasingly implemented across multiple industries that aim to benefit from its efficiency gains. However, the concern about its sustainability has undermined these advantages and slowed adoption.

But, are these concerns accurate? Can they justify the loss of efficiency and transparency that is causing? Is blockchain adoption really a negative environmental tradeoff?

To understand how blockchain is affecting the environment, it is essential to remember how the electricity system works and the most common sources of energy. Most comparisons out there are just focused on specific activities that support this system, such as mining and placing transactions, which are obviously depending on electricity consumption. However, they failed to zoom out to provide some context, comparing blockchain-based solutions, such as cryptocurrencies, with mere equivalents of just one side of a multi-pronged system.

Thus, this article analyses not only the resource intensiveness of Ethereum, but it also covers key aspects of regulation, action plans, and Environmental, Social, and Governance (ESG) activities in order to track their implementation in sustainable technologies.

Electricity impact on the environment

Today, many electric power grids worldwide are governed by a complex network of power plants, transmission and distribution wires, and end-users of electricity. In most countries, end-users receive electricity from centralized power plants that use different energy sources, such as natural gas, coal, nuclear energy, and renewable energy (solar, hydroelectric, wind power).

Figure 1 shows the distribution of energy consumption by end-users in 2018, allocated to industry, residential, commercial, public services, transport, and others. The greatest electric energy consumption is made by the industry worldwide, followed by residencies and commercial buildings.

Why is this relevant? It turns out electricity accounts for 25% of the total greenhouse emissions worldwide, and approximately 62% of electricity comes from burning fuels, mostly coal and natural gas, which is counterproductive for the environment and global warming (EPA, 2021b).

Figure 1. World electricity final consumption by sector 1974 – 2018. Source: iea, 2021.

Mining blocks in a blockchain, namely, creating transactions, involves using powerful computers to solve complex mathematical problems to reach a consensus. Currently, Ethereum is using a proof-of-work (PoW) system, requiring a global network of computers running around the clock to approve transactions. This process has been criticized since it is very energy-intensive.

Some of the criticism has pointed out, for instance, that the Bitcoin network is estimated to consume more energy than several countries, including Argentina and the Netherlands —not taking into account that the application of blockchain has global impacts, delivering more for less energy consumed—. And, as fossil-fuelled power plants still make up a significant portion of the global energy mix (Figure 1), mining can be said to be partly responsible for producing greenhouse gases that cause climate change, just by using computer power. Although, according to the United Nations, the impact of blockchain mining in the climate is far less than that of heavy hitters such as the agriculture, construction, energy, and transport sectors) (UN, 2021).

Yet, the blockchain community has addressed these issues, creating solutions to contribute with better practices. For the Ethereum Foundation, in particular, there is the urgency to deliver these solutions, so there is no longer a trade-off between the systemic benefits of using blockchain against today’s urgent need to reduce fossil fuel consumption.

Meeting ESG targets

“In the space of six or twelve months, investors have gone from thinking about ESG as a side issue to thinking about it as completely core to the future of their funds.“ (MSCI, 2021).

In a global survey where 200 executives at 200 separate asset owners participated, 73% of institutional investors said the pandemic has made them increase ESG investments. They were asked about the three top trends affecting organizations for the next three to five years, and 62% cited climate change and the increasing complexity of ESG measurements over market volatility and regulation. In fact, 90% of funds with more than 200 billion dollars in assets under management are planning to increase ESG integration (MSCI, 2021).

That is why institutions are cautious about adopting new technologies. With most of the companies committing to net-zero targets, implementing new solutions require the insurance of better and sustainable practices. And, it is at this point where blockchain technology generates doubt.

When Ethereum 1.0 was created, Proof of Work (PoW) seemed to be the most efficient consensus protocol to define who could create blocks and how often. Following Bitcoin, this consensus algorithm is still the most used in the emerging industry. However, as pointed out before, it is energy-intensive.

Acknowledging this, the Ethereum Foundation has proposed migrating to Proof of Stake (PoS), a more environmentally friendly solution, reducing greenhouse emissions. So, the question is:

Does Proof of Stake meet the ESG targets?

First, we need to analyze our starting point to run a comparison: Why PoW consumes more energy than PoS?

In general, the processes within Ethereum are (Lewis, 2021):

- Connect to the Ethereum network

- Validate transactions and blocks

- Create new transactions and smart contracts

- Run Smart contracts

- Mine for new blocks

As stated before, what consumes energy the most is the mining process. The current Ethereum network (1.0) uses a “Proof of work” consensus protocol which implies solving a mathematical puzzle that produces the cryptographic link between the current block and the previous block. Miners acting as validators of transactions compete to create new blocks full of processed transactions. The miner that solves the puzzle the fastest shares the new block with the Ethereum network and earns Ether as a reward.

Although it is a good consensus protocol, it requires significant computational power. Every miner has the incentive to increase the probability of being elected for mining by increasing their computational power (speed), meaning investing in GPUs and creating mining farms that discourage the Ethereum network.

Figure 2. Distribution of cryptocurrency mining pools worldwide in 2018 by region. Source: Statista, 2021

Mining participants create valid blocks by spending electricity to find solutions to a mathematical challenge. Even though Ethereum’s PoW maths challenge (called Ethash) allows more common hardware than Bitcoin to be used, in practice, specialized hardware has been created to compete for the blocks’ creation (Lewis, 2021). This translates into more electricity consumption, and given that Ethereum is in the first stages of development, it is an issue that needs to be solved.

In addition, miners’ source of energy defines the impact on the environment. As can be seen in Figure 2. the majority of miners are located in Europe, followed by Asia and North America which in many cases use coal, natural gas, and petroleum fuels as their main energy source. Hence, depending on where the mining is done it is determined the proportion of the actual harm caused to the environment.

Now, to put the energy consumed by the Ethereum network into perspective, we can compare it to Bitcoin. Yet, this needs to be taken with caution, given that Bitcoin is limited in its application cases, to mostly store of value and payment. In contrast, Ethereum offers many other possibilities to implement use cases using its distributed ledger system. Examples like clearing, settlement, securitization, auditation, and supply chain tracking are the most renowned, and all of them use the transaction network based currently in PoW.

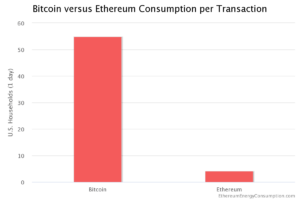

As a point of reference, the following graph shows the total energy consumption for each of these blockchains per transaction, measured by the total number of U.S. households that could be powered by it in a day.

Figure 3. Energy consumption comparison Bitcoin & Ethereum. Source: Digiconomist, 2021

Clearly, regardless of the current consensus protocol used by Ethereum, the criticism raised recently, especially towards Bitcoin, has not much basis with regard to Ethereum. Nevertheless, there is room for improvement.

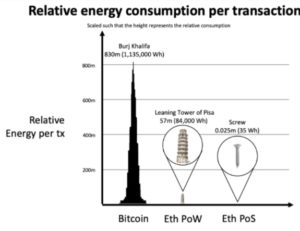

Acknowledging that PoW is, aside from its security, costly in environmental terms, it has driven innovation towards new solutions: Fortunately, Ethereum is upgrading in 2021 the consensus protocol to a more efficient Proof of Stake algorithm called Casper. By switching to PoS, the Ethereum Foundation says that the energy cost of each transaction could be cut by 99.95 percent.

At the same time, many players in the industry want to ensure that any energy consumed by the industry is entirely carbon-free.

In April 2021, three important organizations (the Energy Web Foundation, Rocky Mountain Institute, and the Alliance for Innovative Regulations) formed the Crypto Climate Accord, supported by organizations spanning the climate, finance, NGO, and energy sectors.

The Accord aims to “decarbonize the industry in record time”, and achieve net-zero emissions in the global crypto industry by 2030. With this, the priority that sustainability and environmental concerns have for the blockchain emerging industries is evident.

For an industry that heavily depends on the financial markets’ support and adoption, meeting the ESG targets is unquestionable. And, the willingness to do so is improving the possibilities of broader promotion, enhancing the efficiency-gains that blockchain has the potential to deliver.

What are the last changes in Ethereum, and what to expect?

In “The Impact of Ethererum 2.0,” we analyzed the expected upgrades and their impact in terms of security, decentralization, and scalability. In short, Ethereum has proposed two main changes: the first one, implementing “Proof of Stake” instead of “Proof of work”, as aforementioned, and the second one, applying “sharding” as a scaling solution.

“Proof of Stake” consensus protocol, currently being developed for the Ethereum 2.0 upgrade, establishes a minimum stake in ETH to participate as a validator (32ETH). With this, participating validators are chosen randomly to create new blocks and share them with the Ethereum network (Ethereum, 2020). “The total stake for the selection of each block proposer will consist of the sum of self-stake and the stake delegated from other token holders” (Blandon, 2020).

The updates guarantee secure yet efficient energy usage. With PoS, validators are selected based on the amount of ETH that they have staked (deposited) in the network. Hence, they have an incentive to act honestly (otherwise, their stake will be slashed/destroyed). There will no longer be thousands of graphic cards “mining” and competing for the next block, ensuring that there is quasi no energy consumption other than the cost of the servers that run the nodes.

The consensus mechanism “Proof of Stake” is secured by the fact that an attacker would need 51% of the total staked ETH to defraud the chain and the attacker’s stake would be reduced for malicious behavior. The risk of an attack is reduced as there is a higher probability of losing the stake.

Figure 4. Relative energy consumption per transaction. Source: Ethereum Official blog

According to the Ethereum official Blog, the existing Ethereum network uses about 5.13 gigawatts of power (the equivalent of Peru energy consumption) and Beekhuizen (2021) estimates the network will drop to just 2.62 megawatts after the switch. “This is not on the scale of countries, provinces, or even cities, but that of a small town (around 2,100 American homes).”

This forecast is promising, and, in fact, many big institutions are supporting blockchain adoption.

“The UN believes that blockchain, the technology lying behind these online currencies, could be of great benefit to those fighting the climate crisis, and help bring about a more sustainable global economy.”

With incredibly exciting applications emerging every day and serious thought and investment going towards reducing Ethereum’s energy consumption, institutions acknowledge its potential.

We at micobo are strong believers and supporters of this technology because we have seen what it can do, and we have benefited from the multiple efficiency gains it delivers. The opportunities for business and our planet are huge, not least when increasing trust through public transparency.

About micobo

micobo GmbH is a leading European software company for Security Token Offerings and Blockchain Software Development (DLT). It provides fully compliant software solutions for Security Token Offerings and advises on structuring DLT- and Blockchain-based Securities. micobo empowers financial institutions with state-of-the-art technology focusing on providing a better customer experience and achieving measurable results.

Authors

Laura Andrade (la@micobo.com)

Luisa Blandon (lb@micobo.com)

Bibliography

- Digieconomist. Ethereum Energy Consumption Index. 2021. Retrieved from https://digiconomist.net/ethereum-energy-consumption/. Last accessed: 18.06.2021

- EPA. About the U.S. Electricity System and its Impact on the Environment. 2021. Retrieved from https://www.epa.gov/energy/about-us-electricity-system-and-its-impact-environment. Last accessed 10.06.2021.

- EPA. Sources of Greenhouse Gas Emissions. 2021b. Retrieved from https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions. Last accessed 10.06.2021.

- Ethereum Official Blog. A country’s worth of power, no more!. 2021. Retrieved from https://blog.ethereum.org/2021/05/18/country-power-no-more/. Last accessed: 18.06.2021.

- iea. Electricity Information: Overview. 2021. Retrieved from https://www.iea.org/reports/electricity-information-overview. Last accessed 10.06.2021.

- MSCI. (2019). MSCI ESG Sustainable Impact Metrics. Retrieved from shorturl.at/lyDZ8. Las Accessed: 21/03/2021.

- MSCI. (2021). MSCI Investment Insights 2021. Retrieved from https://www.msci.com/our-clients/asset-owners/investment-insights-report. Las Accessed: 21/03/2021.

- MSCI. (2021). ESG Indexes. Retrieved from https://www.msci.com/our-solutions/esg-investing/esg-indexes. Last accessed: 22/03/2021.

- MSCI. (2021b). Climate Data & Metrics. Retrieved from https://www.msci.com/our-solutions/esg-investing/climate-solutions/climate-data-metrics. Last accessed: 22/03/2021.

- MSCI. (2021c). Sustainable Finance Solutions. Retrieved from https://www.msci.com/our-solutions/esg-investing/sustainable-finance-solutions. Last accessed: 22/03/2021.

- PRI. (2018). A Practical Guide to Active Ownership in Listed Equity. Retrieved from shorturl.at/chtHO . Last Accessed: 22/03/2021

- Sedlmeir, J., Buhl, H.U., Fridgen, G. et al. The Energy Consumption of Blockchain Technology: Beyond Myth. Bus Inf Syst Eng 62, 599–608, 2020. https://doi.org/10.1007/s12599-020-00656-x.

- statista. Distribution of cryptocurrency mining pools worldwide in 2018 by region. 2021. Retrieved from https://www.statista.com/statistics/731449/geographical-distribution-of-mining-pools/. Last accessed 10.06.2021.

- The Guardian. Ethereum cryptocurrency to slash carbon emissions. 2021. Retrieved from https://www.theguardian.com/technology/2021/may/19/ethereum-cryptocurrency-to-slash-carbon-emissions. Last accessed 10.06.2021.

- UN. A ‘pointless way of using energy’?. 2021. Retrieved from https://news.un.org/en/story/2021/06/1094362. Last accessed 10.06.2021.